Michael Kachmar, Editor

(If not displaying properly or banners not loading, click here.)

Our Product Pick

Citizen Systems America (Torrance, CA) has unboxed its new desktop barcode printer, the 4" CL-E300 (Direct Thermal)/CL-E321 (Thermal Transfer). In compact size of 6.7 in. (W) x 8.2 in. (D) x 6 in. (H), weighing 4.4 lbs., and with drop-in paper loading and front exit, the CL-E300/CL-E321 has standard Ethernet, USB, and Serial. CL-E300 has maximum print speed of 8 in./204 mm per second at 203 dpi. CL-E321 has maximum print speed of 6 in./152 mm per second at 300 dpi. Intended for "low to mid-volume printing," at "the most economical price," the CL-E300/CL-E321 features adjustable media sensor, tool-free maintenance, 5" outside diameter (O.D.) media bay, and the company's web "LinkServer." It carries common emulations.

Citizen's CL-E300/CL-E321 Barcode Printer

COMPANY BUSINESS

A Light Shines on Shift4 Payments

At the beginning, there was United Bank Card, then Harbortouch, then Lighthouse Network. Now, following the purchase of the payment processor Shift4 Corporation (Las Vegas, NV), Jared Isaacman's ensemble--comprising Harbortouch, Future POS, POSitouch, and Restaurant Manager--has been rebranded as Shift4 Payments (Allentown, PA). Adding to its powerful family of software, hardware configurations, and philosophy of "POS-as-a-Service," it now adds the well-established gateway by Shift4 (dubbed "Dollars-on-the-Net").

Founded in 1994, Shift4 holds 11 patents for proprietary payment technologies, and helped pioneer data tokenization, Point-to-Point Encryption (P2PE), and EMV. It processes in excess of $60 billion annually and, when combined with the former Lighthouse Network, will process in excess of $100 billion annually. Customers include widely recognized brands such as Caesars Entertainment, Choice Hotels, the PGA Tour, Red Roof Inn, and Sleep Number. (It was only last year, readers will recall, when Isaacman purchased three of the key ISVs in hospitality POS--Future POS, POSitouch, and Restaurant Manager.)

"This acquisition is transformational for our organization as it enables us to power our industry-leading POS brands with a best-in-class payments platform that is second to none in terms of security, reliability, and functionality," declared Isaacman, who serves as CEO of the new Shift4 Payments. "But this story is not just about Harbortouch, Future POS, POSitouch, and Restaurant Manager, as we also aim to empower the over 300 existing Shift4 software integrations with game-changing benefits." Acquisition terms were not disclosed by Lighthouse Network or Shift4 Corporation.

Jared Isaacman, CEO of Shift4 Payments, Successor to the Lighthouse Network

Crane Hopes to Cash In

A provider of cash handling systems, Crane Payment Innovations (Malvern, PA), has premiered its new bundled pay station for retail, dubbed "Paypod." It includes one of the company's coin recyclers, one of its note recyclers, and its "POSlinq" Software (along with power supply and USB Hub). At present, three versions are offered, with the system "designed to evolve with the market," in the words of Jan-Hinrik Bauwe, VP and GM of the Retail Channel at Crane Payment Innovations.

A number of benefits are offered, according to Bauwe, including time savings, reduced shrink, and elimination of hygiene concerns in cash handling. With no need for development, the POSlinq Software links to popular Windows POS. It validates incoming cash and controls the release of change for the transaction. It also removes the need for daily cash reconciliation.

In discussion with RRN.Com, Crane Payment Innovations indicated its intent to market through VARs and ISVs in POS. After demonstrating its Paypod at the recent National Retail Federation (NRF) Show in New York City, it will feature Paypod at the EuroCIS Show in Dusseldorf, Germany, at the end of February. As intended markets, it cited cash-heavy businesses such as bakeries, tobacco shops, delicatessens, etc.

Crane's Paypod Embedded in Counter

Worth Your While

Inspire

Retail Solutions Providers Association (RSPA)

January 28-31

Waikoloa Beach, Hawaii

NGA Show

National Grocers Association

February 11-14

Las Vegas, NV

Shoptalk

March 18-21

Las Vegas, NV

Transact

Electronic Transactions Association

April 17-19

Las Vegas, NV

NRA Show

National Restaurant Association

May 19-22

Chicago, IL

ALL IN THE FAMILY

Epson Multi-Tasks (TM-H6000V)

Epson America (Long Beach, CA) has unwrapped its new multifunction thermal receipt printer with check handling, designated the OmniLink TM-H6000V. With an eye towards future-proofing, the OmniLink TM-H6000V has triple interface connectivity, including built-in USB and Ethernet. Additionally, it supports printing of web-based applications utilizing Epson's "ePOS," as well as online ordering by Server Direct Printing.

In physical dimensions of 7.3 in. (W) x 11 in. (D) x 7.1 in. (H), and weight of 9.7 lbs., the OmniLink TM-H6000V features receipt print speed of 13.8 in./350 mm per second at 203 dpi with 3" print width. (As for check handling: slip at 5.7 in./145 mm per second; endorsement at 4 in./102 mm per second). A printhead reliability of 200 km and extended auto-cutter life of 3 million cuts are cited by Epson America. Advanced paper-saving functionality reduces usage by up to 47%.

In keeping with today's retail environment, the OmniLink TM-H6000V pairs with mobile devices via Wi-Fi (802.11), Bluetooth Low Energy (BLE), and Near-Field Communication (NFC). Also of note: remote monitoring of printer status and an intuitive control panel with visual error notifications. "Our new OmniLink TM-H6000V allows customers to transact nearly anywhere and anytime, lessens solution downtime, and creates fewer service calls," emphasized Gregg Brunnick, Director of Product Management for POS Printers and Robotics at Epson America.

Epson's New OmniLink TM-H6000V POS Printer

A White Album by HP (ElitePOS)

A white version of its newest terminal, ElitePOS, has been unveiled by HP (Palo Alto, CA). Offered in response to customer request, according to the company, and accompanying the previous version in black, the white ElitePOS simulates the design of tablet POS--with touchscreen head unit, column stand, and flat connectivity base. In performance, it incorporates 7th Generation Intel CPUs, DDR4 RAM, M.2 SSDs, and Windows 10. A projected-capacitive 10" display (1920x1080) has been ruggedized to MIL-STD-810G.

A number of innovations follow, including channeling for water spills on the head unit, optimized air flow via side venting, edge-to-edge narrow bezel glass, single cable for power and connectivity, and optional integrated 3" thermal receipt printer inside the stand. In keeping with Elite by HP, ElitePOS brings impressive security--HP Sure Start Gen 3 (against corruption), HP Device Guard (against unlisted apps), and HP Credential Guard (against unauthorized users). In addition, of particular interest to the channel, HP's Care Pack furnishes on-site repair anywhere in the U.S.

"Retailers want technology that not only delivers the performance and versatility they need but enhances their stores to provide an experience-focused shopping environment their customers increasingly expect," observed Aaron Weiss, VP and GM of Retail Solutions at HP Inc. "Whether retailers want to supplement their traditional point-of-sale system, or implement a sleek, modern multi-function or mobile system, HP Retail Solutions has a product to fit nearly every need." Addressing both retail and hospitality, HP ElitePOS was debuted in August of 2017.

ElitePOS in White Version by HP

Join the Party at No Charge

|

|

|

|

|

|

||

|

|

||

|

|

|

|

|

|

||

Do you need to reach the POS & Auto ID resellers who really drive business? With the most targeted editorial environment, and on the most cost-effective basis?

E-mail

Michael Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry ! Use the links below to catch up :

ALLIANCES

Datacap Shows Heart

Datacap Systems (Chalfont, PA) has completed its second U.S. EMV Level 3 Certification with Heartland Payments that adds support for ID TECH (Cypress, CA). Utilizing its popular payments middleware, NETePay, Datacap now supports EMV Level 3 processing through Heartland with reader models such as Augusta, Augusta S, and MiniSmart from ID TECH. It features Tip Adjustment, PCI-Validated Store and Forward, Point-to-Point Encryption (P2PE), and Tokenization.

"ID TECH's line of EMV readers is an important addition to Datacap's semi-integrated EMV payments offering," reported Justin Zeigler, Director of Product Strategy at Datacap Systems. "Datacap's POS partners now have a cost-effective and easy-to-implement path to EMV for merchants that are looking to mitigate their chargeback liability while maintaining pre-EMV processes." As one of the longtime leaders in payments middleware, Datacap Systems has an ongoing effort: in November 2017, it announced U.S. EMV Level 3 Certification with Moneris Canada; in October 2017, it announced U.S. EMV Level 3 Certification with Vantiv Core for Telium 2 from the Ingenico Group.

On its part, Heartland Payments, operating now under Global Payments (Atlanta, GA), has launched its next-generation cloud-based restaurant management platform, entitled "Xenial." Via Software-as-a-Service (SaaS), it supports iOS, Android, and Windows. Heartland, readers will recall, earlier purchased four key ISVs in hospitality POS--Dinerware, Digital Dining, pcAmerica, and Xpient Solutions. As executives, there's Christopher Sebes, President (formerly of Xpient), and Andre Nataf, SVP of its Dealer Channel (formerly of Digital Dining).

EMV Level 3 Certification for Datacap, Heartland Payments, and ID TECH

A Certifiable MSP for Retail/Hospitality

A "full lifecycle, managed service provider" for retail and hospitality IT has been created by the acquisition of Certified Retail Solutions (Dover, NH) by Spencer Technologies (Northborough, MA). As expected, it spans staging, configuring, deploying, and on-site repair of single-source or multiple-source software and hardware. In POS, Certified Retail Solutions, which was founded in 1991, and has evolved from Certified Parts Warehouse, serves as Together Commerce Alliance Partner for Toshiba Global Commerce Solutions (Toshiba GCS).

"Off-line brick-and-mortar retail is under siege from e-commerce, creating an opportunity for the most innovative companies to set themselves apart in an ever-changing climate," indicated David Strickler, President and CEO of Spencer. "If retailers can rely on a single vendor to service all their in-store technology needs, we can serve as a trusted partner and extension of their team, allowing them to devote more resources to navigating their business through this challenging period. Our journey over the next five years will make us the most innovative, global retail services company."

Established in 1972, Spencer Technologies has approximately 450 employees, including 200 technicians, in the U.S., Canada, Mexico, and Europe. It added 66, as well as three distribution centers, from Certified Retail Solutions. A long roster of major retail customers for Spencer Technologies includes Aeropostale, Anthropologie, Barnes & Noble, Eddie Bauer, Gap, J. Crew, Kroger, Macy's, McDonalds, Pizza Hut, Talbots, and Toys "R" Us. A recent customer for Certified Retail Solutions: The Yankee Candle Company.

David Strickler, President/CEO, Spencer Technologies

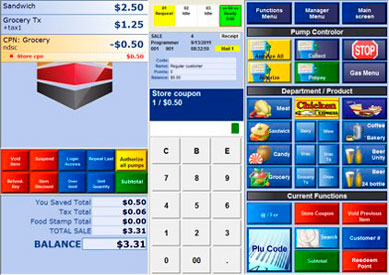

Code Corner

Focus POS (San Antonio, TX), prominent hospitality POS ISV, has released its version of SaaS, named, appropriately enough, "Focus-as-a-Subscription," or "FAAS." At "low monthly cost and no long-term commitment," FAAS includes primary functionalities in point-of-sale, inventory control, table management, and back-office reporting. Add-on modules, at additional fee, include labor scheduling, customer relationship management (CRM), delivery, and interface to property management systems (PMS). In addition, through FAAS, Focus POS will facilitate customization and expansion for the restaurant owner. Established in 1990, Focus POS cites the clarity and flexibility of its buttons, tabs, and screens. "Our philosophy is simple: create a smart, uncomplicated solution that positions our customers for profitability and competitive advantage," stated Mike Hamm, COO at Focus POS.

Focus POS Debuts "FAAS"

NOTES FROM THE FIELD

Appetize Grows Appetite

Appetize (Playa Vista, CA) has raised $20 million in Series B funding. This brings the company's total funding to date to over $45 million. This round was led, once again, by Shamrock Capital Advisors (Los Angeles, CA). Started in 2011, and demonstrating 100% year-over-year growth, Appetize has emerged as one of the major players in POS for arenas, stadiums, convention centers, and theme parks. It competes with Oracle, Agilysys, and NCR.

A full suite of products spans POS, Inventory, and Back-Office. As an example, it will serve this year's Super Bowl at U.S. Bank Stadium in Minneapolis, MN. A roster of hardware includes iPods for hawkers, iPad Mini's for in-seat mobile ordering, 10" All-in-One POS for concessions, 15" Elo's PayPoint POS for bars and clubs, integration with Cisco for digital menu boards, and VenueNext integration for mobile ordering on smartphones. As O/S, there's iOS and Android.

"Since inception, Appetize has focused on bringing a combination of innovative and reliable POS products to the enterprise customer first, and the results validate that focus," noted Max Roper, Co-Founder and CEO of Appetize. "We're replacing legacy competitors at record speed and driving leading initiatives like self-service and mobile ordering to big brands. This additional investment gives us even more ability to grow, and capture significant market share." Appetize now has 200 employees. No word yet on channel plans.

Series B Funding for Appetize POS

Your Q&A on QSA

A new Associate Qualified Security Assessor (QSA) Program by the Payment Card Industry Security Standards Council (PCI SSC). Its goal: to help fill the growing gap in the number of cybersecurity professionals for the payments industry. As most readers know, QSA Companies are data security firms certified by the PCI SSC to perform on-site assessments of compliance with the complicated PCI Data Security Standard (PCI DSS). As such, they fill an integral role in POS.

"An overall shortage of cybersecurity talent is making it difficult for QSA Companies to find suitable new assessors. As a result, assessors are increasingly expensive to hire and retain, driving assessment costs up for merchants that rely on their services," elaborated Mauro Lance, COO of the PCI SSC (Wakefield, MA). "The Associate QSA Program provides a professional track for new entrants to join the industry and gain experience to qualify as a QSA, easing the resource constraints for QSA Companies, and ensuring high-quality QSA services are available for merchants and service providers into the future."

Under this effort, QSA Companies are invited to review the QSA Qualification Requirements, and submit applications for eligible employees via the website of the PCI SSC. In addition to being employed by QSA Company and working under the supervision of an experienced QSA mentor, Associate QSA pre-requisites include a college or university degree in an IT or security-related field (or two years of experience). Successful applicants will need to complete the online Fundamentals Course of the PCI DSS, attend instructor-led training, and pass an exam before becoming an Associate QSA.

A New "Associate" Qualified Security Assessor Program from the PCI SSC

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products

and offers for resellers.

POS & Peripherals

Aures

Bematech

Harbortouch

Hewlett-Packard

Pioneer POS

Poindus America

POSBANK USA

Posiflex

Barcode & Transaction Printers

Brother Mobile

CognitiveTPG

Godex Americas

Cash Drawers

APG Cash Drawer

MMF POS

Data Collection

CipherLab

Code Corporation

Denso ADC

Janam Technologies

Integrated Payment Solutions

Datacap Systems

Cayan

iPayment

Monetary LLC

Sterling Payment

Keyboards & Mobile POS

Cherry Americas, LLC

TG3 Electronics

Mounts for POS

SpacePole

Receipt Printers

Bixolon America

CognitiveTPG

Epson America

Star Micronics

Thermal Printers

Seiko Instruments USA

INSTALLATIONS

Un"LOC"king Checkout

A new semi-integrated payment processing module has been piloted at several grocery chains by LOC Software (Laval, QC, Canada) and Index (San Francisco, CA). It combines the "1-Second" EMV by Index with LOC's Store Management Suite (SMS) for POS. Additional technology includes 2048-Bit RSA Encryption, Payment Card Industry (PCI) Compliance, and Remote Device Management.

When customers check out, they may enter their e-mail on the PIN Pad to sign up for digital receipts and opt-in to marketing communications. After, Index logs customer preferences so they'll automatically receive e-receipts upon future visits. In addition, volunteered customer e-mails may be integrated with the targeted offer module by LOC Software.

"This integration has been highly anticipated by our teams and our channel because we knew it would be a big hit with our independent grocers," relayed Francois Labelle, Director of Development at LOC Software. "Every retailer can benefit from a flexible, future-proof solution that improves security and reduces costs, while speeding up checkout and improving customer engagement." A bundled solution is supported on Verifone and Ingenico PIN Pads and certified to major payment processors such as Chase Paymentech, First Data, and Vantiv/Worldpay.

LOC Software Store Management Suite (SMS)

TUCK-ing In SATO

SATO Global Solutions (Fort Lauderdale, FL), a wholly owned subsidiary of SATO Holdings, and retail brand UNTUCKit are testing an in-store system that uses data collected by RFID on men's shirts, beacon-based traffic counters from RetailNext (San Jose, CA), and the POS to identify the optimal merchandising mix. It has been installed at UNTUCKit's recently opened flagship store on Fifth Avenue in New York City. A success story of "e-commerce coming to brick-and-mortar," UNTUCKit opened 20 locations in 2017, with plans for another 25 in 2018.

By tracking the customer's choice of "try-on" shirts offered by store associates, the system sheds light on which SKU's are bestsellers so store managers can optimize inventory levels in real time. It also suggests which sizes or styles can be reduced in volume due to low demand, reducing inventory cost, and allowing UNTUCKit to redirect their investments toward more popular, or new, SKU's. It also helps to understand how associate behavior, and training, influences shoppers.

"When people ask about examples of IoT in retail, I talk about this pilot. We have the ability to 'upgrade' the physical store in the way that captures the same kind of data we get during online interactions," enthused Keith Sherry, COO of SATO Global Solutions. "Retailers looking to compete in brick-and-mortar have more tools than ever to understand shopper behavior. The key is then applying these insights to align the customer experience with expectations across all channels."

A Combination of RFID, Beacons, and POS Data Boosts Inventory Visibility

Channel Factoid

Affluent consumers--those making more than $100,000--are becoming more price sensitive, according to research by First Insight. In fact, 42% of such consumers now frequently shop at discount retailers, versus only 27% at full price retailers, with 36% saying their discount shopping has increased. Also, 21% of affluent consumers reported they were more inclined to visit online discount retailers, compared to only 12% of overall consumers. (Interestingly, more than half of affluent consumers, 53%, utilize their Amazon Alexa or Google Home to research pricing, and three-quarters, 74%, always check Amazon.com.) Similarly, 39% of affluent shoppers are using their mobile devices to compare prices while in-store, compared to only 26% of consumers overall. Among the affluent, the two most important factors that would make them want to shop at brick-and-mortar, versus online, are being able to see and touch the product (36%) and being able to take the product home (26%). No surprise there. Furthermore, price promotions and coupon availability were important to only 10% of affluent consumers. Favorite discount retailers include TJ Maxx (30%), Marshalls (28%), and Home Goods (23%). Most researched items: electronics (65%), apparel (48%), shoes (42%), home appliances (38%), and jewelry (31%). "It's more critical than ever that retailers and brands offer differentiated products at the right price in order to attract the informed, affluent shopper on the hunt for deals both in-store and online," expounded Greg Petro, Founder and CEO at First Insight (Warrendale, PA).

HELLO GOODBYE

Electronic Payments: Entrepreneur

Electronic Payments (Calverton, NY) has been recognized as one of the "Best Entrepreneurial Companies in America." As part of the Entrepreneur 360 for 2017, selected by Entrepreneur Magazine, Electronic Payments exhibited the necessary balance of "impact, innovation, growth, and leadership." Founded in 2000, it provides payment processing services and point-of-sale technologies to merchants in the U.S., with interest in our channel of VARs and ISVs.

"There is no other industry that is growing as rapidly as financial technology, and the disruptions and shifts that we're seeing have provided unprecedented opportunity to drive innovation in the payments space," commented Michael Nardy, Founder and CEO of Electronic Payments. "This recognition validates our commitment to empowering small businesses with relevant, competitive, state-of-the-art payment technologies. We're honored to be a part of this prestigious group of companies who share the same philosophies and strive for excellence across all aspects of business."

"Our annual evaluation is a 360-degree analysis of top privately-held companies representing and serving a variety of industries," contributed Lisa Murray, Chief Insights Officer of Entrepreneur Media, Inc. "These businesses are real-world case studies for any entrepreneur who seeks to master the four pillars that can greatly impact the longevity and growth of their businesses--impact, innovation, growth, and leadership. With the Entrepreneur 360, success is measured by achieving balance throughout the entire organization, predicated by revenue."

Electronic Payments Annual Gathering in Boca Raton, FL, Office. Michael Nardy, CEO, in Front Row, Second from Left.

An Ace at Agilysys

Agilysys (Alpharetta, GA) has engaged industry veteran Don DeMarinis as its SVP of Sales for Americas. A long list of positions in the hospitality industry includes GM for Brolin Retail Systems (1995 to 2008), VP of Leisure and Entertainment for Micros (2008 to 2014), VP of Sports and Entertainment for Oracle Hospitality (2014 to 2016), EVP/Chief Revenue Officer for Gusto (2016 to 2017), and Chief Commercial Officer for QikServe Ltd. (2017 to 2018). Among its products for casinos, restaurants, and lodging, Agilysys fields InfoGenesis POS.

"Don's strong background in sales and technology, combined with his expertise in the hospitality industry, make him uniquely qualified for the position of SVP of Sales, Americas at Agilysys," remarked Ramesh Srinivasan, President and CEO. "The members of the executive search team seized on Don as our top choice from among the many terrific candidates that sought this opportunity, based upon his understanding of how technology can improve customers' business performance, his proven track record of consecutive sales growth selling competitive systems in our industry, and his demonstrated success in building and motivating world-class sales teams. I am confident that Don will help Agilysys accelerate our growth in every industry we target."

"I'm excited to join a hospitality industry leader like Agilysys," shared DeMarinis. "With the increasing demand for mobility solutions to enhance the guest experience, the need for a single view of the guest to grow patron loyalty, and the demands for more efficient operations across the property, Agilysys is perfectly positioned to help take customers to the next level. Exciting opportunities are ahead for the company, and I look forward to working with both the sales and wider Agilysys teams to help drive continued growth."

Don DeMarinis, SVP of Sales for Americas, Agilysys

PinPoint Media

All Rights Reserved