Michael Kachmar, Editor

(If not displaying properly or banners not loading, click here.)

Our Product Pick

MobileDemand (Cedar Rapids, IA) has stocked its rugged case/sled, an "xCase," for Microsoft Surface Pro and Go Tablets. Versions integrate barcode scanner, MSR, or combination of barcode scanner/MSR. (Optional camera and EMV). As scan engine, there's Honeywell's 1D/2D N6703; as MSR, there's MagTek's MagneSafe Security Architecture. As ruggedness, MobileDemand's xCases are engineered to meet military standards (e.g., rubber bumpers, MIL-STD-810G). A variety of accessories and mounting options are offered. "We took the best of our rugged xCases and transformed them into the ultimate all-in-one solution, custom designed to work seamlessly with Microsoft Surface Tablets," proclaimed Matt Miller, President of MobileDemand.

MobileDemand xCases for Microsoft Tablets

COMPANY BUSINESS

Worldline/Ingenico Comes to PPaaS

Worldline/Ingenico has completed the second phase of development of its new architecture: Payments Platform-as-a-Service (PPaaS). As part of Worldline's Terminals, Solutions and Services Division (TSS), commercial launch of PPaaS will happen in North America in 2022. It seeks to make Worldline/Ingenico into "an ecosystem enabler and trusted technology partner in the new world of cloud-based payments."

As device and partner agnostic, Worldline/Ingenico's PPaaS will allow partners to activate features in order to create or enhance the experience of their merchants' offerings through Open APIs (Application Programming Interfaces). "We build the core capabilities as well as the connections to a variety of players in different fields of the commerce ecosystem, so that whether you're a payment processor or a solutions integrator, when you join the PPaaS ecosystem, you can pick and choose the elements that you want in order to design and deliver the best experience to your merchant customers," declared Giulio Montemagno, SVP and Managing Director of PPaaS at Worldline TSS. An ecosystem encompasses banks, acquirers/gateways, and ISVs.

As of now, Worldline/Ingenico has onboarded 16 foundational partners to co-design and test the solution for its TSS Division. It includes the following: acquirer, Bambora; payment service provider, PayU; mobile payment platform, Alipay; payment network, Discover; buy-now/pay-later consumer credit providers, Afterpay and Fiizy; e-cash and digital wallet, Paysafe; fraud prevention specialist, Forter; loyalty services player, CardGenY; hospitality solutions integrator, Shiji; risk and compliance firm, Sphonic; Brazilian ISV, POS Controle; AI-based identity certifier, Onfido; and blockchain technology developer, nChain. In North America, this PPaaS will be delivered through Ingenico, A Worldline Brand (Alpharetta, GA).

Worldline/Ingenico Develops "Payments Platform-as-a-Service" for the Payments Ecosystem

Datacap Visits the "Zoo"

A bolt-on functionality for loyalty/membership in POS (and in particular, for the SMB), has been fashioned through partnership by Loyalzoo (London, UK) and Datacap Systems (Chalfont, Pa). It employs Datacap's e-commerce integration, entitled "Pay API" (Application Programming Interface), offered as part of Datacap's processor-agnostic payments gateway, NETePay Hosted. (A longstanding player in the channel for payments/POS, Datacap also has Pay API-ready partners in areas such as pay-at-the table, text-to-pay, online ordering, and self-service kiosks.)

"Now ISVs/VARs can utilize Loyalzoo's membership tie-in to provide an integrated membership platform to their merchant customers, allowing for recurring billing," explained Justin Zeigler, Director of Product at Datacap Systems. "The merchant charges their customers for the monthly membership fees via Loyalzoo, which ties to the POS. A core benefit beyond this added functionality is that the merchants can tie payments from all channels--in-store, e-commerce, membership--through the merchant processor of their choice via NETePay Hosted."

"We developed our membership platform to offer small and medium-sized businesses this 'prime-style' loyalty program," relayed Massimo Sirolla, CEO of Loyalzoo. "Instead of just hoping customers will turn up, a guaranteed recurring revenue stream gives merchants peace of mind and an opportunity to plan more long-term. We have thousands of merchants using our service and loving it. Our partnership with Datacap is an incredible opportunity to make it available to a much wider range of merchants across many more POS platforms."

Adding Loyalty/Membership Functionality to SMB POS Via Loyalzoo and Datacap Systems

Worth Your While

NRA Show

National Restaurant Association

May 22-25

Chicago, IL

[Ed. Note: Cancelled for 2021]

SEAA Conference

Southeast Acquirers Association

May 24-26

Bonita Springs, FL

NRF Show

National Retail Federation

June 6-8

New York, NY

[Ed. Note: Virtual for 2021]

RetailNOW

Retail Solutions Providers Association (RSPA)

July 25-28

Nashville, TN

Western Foodservice & Hospitality Expo

Clarion Events

August 22-24

Anaheim, CA

The NGA Show

National Grocers Association

September 19-21

Las Vegas, NV

Money 20/20

Ascential

October 24-27

Las Vegas, NV

ALL IN THE FAMILY

Bixolon Builds With 2 x 4

Bixolon America (Gardena, CA) has unwrapped its new thermal label printers: Model XD5-40tR and Model XT5-40NR. With print/encode capabilities for UHF RFID, both the XD5-40tR and XT5-40NR furnish print width of 4 in./102 mm. A close spacing on inlay (minimum pitch of 0.6 in./15 mm) reduces media waste. "These new rugged and reliable label printers produce clear, concise RFID labels to enable fast and easy data collection," commented Paul Kim, GM at Bixolon America.

In desktop clamshell design, the Model XD5-40tR measures 8.3 in. (W) x 11.2 in. (D) x 7.4 in. (H) and weighs 5.5 lbs./2.5 kg. It features print speed as high as 6 in./152 mm per second at 203 dpi (with choice of optional 300 dpi resolution). As memory, it includes 256 MB SDRAM and 256 MB Flash. It supports 1/2-in. and 1-in. core ribbon (74 m and 300 m) and offers field-installable auto-cutter and peeler. Also, there's USB, USB Host, Serial, Ethernet, Bluetooth, and 802.11 WLAN.

Intended for more industrial settings, with metal case and double folding door, the Model XT5-40NR measures 10.6 in. (W) x 19.3 in. (D) x 12.8 in. (H) and weighs 30.8 lbs./14 kg. It features print speed as high as 14 in./356 mm per second at 203 dpi (with choice of optional 300 or 600 resolution). As memory, it includes 512 MB SDRAM and 512 MB Flash. In addition to standard display (full color 3.5" or full color touch 4"), it has USB, Serial, Ethernet, Bluetooth, and 802.11 WLAN. As options, there's auto-cutter, peeler, rewinder, and rewinder+peeler.

Bixolon Debuts New RFID Label Printers

Code Exhibits the CR5200

Code Corporation (Salt Lake City, UT) has unveiled its new Code Reader 5200 Presentation Scanner. In compact footprint of 6 in. (H) x 3.6 in. (W) x 2.8 in. (D), weighing 11.2 oz./318 g, the CR5200 offers high-speed omni-directional reading of 1D/2D symbologies. Incorporating 1.2 Megapixel CMOS sensor, it features optical resolution of 1280x960, 51-degree horizontal x 40-degree vertical field of view, and extended read range (e.g., 8 in./203 mm for 13-mil UPC). Advanced image capture technology accommodates reading of small, low-contrast, and damaged barcodes on any surface type such as plastic bags, metal, and low-light illuminated mobile device screens, emphasized Code.

As ease-of-use, the CR5200 has hands-free operation, enhanced motion detection, single blue targeting bar, and good-read feedback (including audible tone and LED). It offers data parsing/formatting in support of system compatibility, connectivity via RS-232 and USB 2.0, and an IP-52 rating for water and dust ingress. As protection against cleaning chemicals, its plastic casing carries the company's Level 2 CodeShield.

"The new CR5200 is the perfect barcode reading device for high-traffic, fast-paced environments such as hands-free retail point-of-sale or event ticketing, admission, and access control purposes," suggested Jana Buchanan, Senior Product Manager of Hardware for Code Corporation. "The CR5200 has an optional advanced age-verification feature that allows businesses to scan driver licenses and IDs, and also capture designated consumer information for credit applications, loyalty programs, and marketing lists without any additional hardware." It replaces two end-of-life models at Code: the CR5020 and CR5025.

Code's New CR5200 Barcode Scanner

Join the Party at No Charge

|

|

|

|

|

|

||

|

|

||

|

|

|

|

|

|

||

Do you need to reach the POS & Auto ID resellers who really drive business? With the most targeted editorial environment, and on the most cost-effective basis?

E-mail

Michael Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry! Use the links below to catch up:

A Message From the Editor

As we enter another year, our mission stays constant: to fill the need for timely, focused, non-biased news in the channel for POS & Auto ID. If anything, that need grows more pressing in the face of changes in technology, go-to-market strategies, business models, and consumer preferences. We look forward to continuing that mission and welcome your suggestions and thoughts on improvement.

Michael Kachmar, Editor

INTEGRATION

Revel's "Pay" Day

Paytronix Systems (Newton, MA) has certified its customer engagement platform with the cloud- and tablet-based point-of-sale by Revel Systems (Atlanta, GA). It adds the full functionality of Paytronix Rewards--loyalty, online ordering/delivery management, and stored value--to Revel Enterprise POS. With its focus on restaurants and convenience stores, Paytronix serves more than 400 brands across 30,000 locations. Adding Revel enlarges enlarges its roster of integrations in POS.

"Revel is bringing retailers the tools they need to identify and market to customers right at the POS, with on-demand cloud access to the loyalty and customer engagement solutions by Paytronix," related Matt d'Arbeloff, Head of Strategy for Paytronix Systems. "With this integration, customers may simply deploy the solutions by Paytronix--proven to drive additional visits and spend--right from Revel's Cloud." A Revel Management Console consolidates sales, redemption, and accounting.

A series of sizeable contract wins announced over the past two years, Chris Lybeer, Chief Strategy Officer at Revel Systems, states, "Revel is now the solution of choice for large chains implementing cloud-based POS. A key part of our success in this market segment is Revel Enterprise's Open API (Application Programming Interface), which makes it easy to extend our platform with best-of-breed solutions like Paytronix." In the SMB, Revel Systems offers its Revel Essentials POS.

Another Partner for Revel Systems' API

CBS Keeps "Time"

A synchronicity between point-of-sale and workforce management has been furthered by Custom Business Solutions (Irvine, CA) and TimeForge (Lubbock, TX). In support of CBS NorthStar by Custom Business Solutions--its multi-unit POS--the labor schedules by TimeForge are developed from diverse inputs, including, reportedly, Machine Learning (ML) and Artificial Intelligence (AI). A combined solution with CBS NorthStar addresses the restaurant industry.

"Unlike other workforce management solutions, the TimeForge platform covers the full employee lifecycle, not just one or two aspects," noted Art Julian, CEO of Custom Business Solutions. "Operators want to be able to see real-time sales and real-time labor to run their day-to-day operations while managing compliance in a seamless fashion. TimeForge's enterprise focus means that our customers now have full labor management, including sales forecasting, event coordination, applicant tracking, and payroll."

"One of the main benefits of the integration for TimeForge customers is that it allows them to take advantage of NorthStar's omnichannel ordering capabilities, which include online and mobile ordering options for restaurants," testified Audrey Hogan, Solution Manager for TimeForge. "Online and mobile ordering are more important than ever right now because of the pandemic, and now we can help staff around forecasted demands of online, delivery, and in-store orders." In 2020, TimeForge spun out of its parent company, the grocery/supermarket ISV, Truno. It also partners with ParTech and Dumac in POS.

A Synchronicity Between Point-of-Sale (Custom Business Solutions) and Workforce Management (TimeForge)

Code Corner

Star Micronics America (Somerset, NJ) has launched its StarXpand SDK (Software Development Kit) for the open-source, cross-platform, mobile application framework of React Native. Available on GitHub, StarXpand SDK for React Native will help shorten the development time and maintenance costs involved with connection and control of the company's thermal printers, according to Star Micronics America. It employs the new StarIO10 framework, which offers multiple advantages, such as: asynchronous communication, allowing print jobs to happen in parallel; an emulation-free design, enabling one StarXpand document to work with any printer by Star; human-readable command creation, for more transparency; faster printer search, allowing users to discover all devices in less than one second; and logging functionality for debugging between the printer and O/S. "As React Native becomes more prominent in the industry, the StarXpand SDK will be there to help developers easily create cross-platform solutions for POS," remarked Jon Levin, Director of Product Management at Star Micronics America. "Easy-to-use and developer-friendly, the new StarIO10 framework is at the heart of that and will provide a great foundation for our SDKs going forward."

StarXpand SDK for Cross-Platform React Native

Jon Levin, Director of Product Management, Star Micronics America

ENVIRONMENTS/PLATFORMS

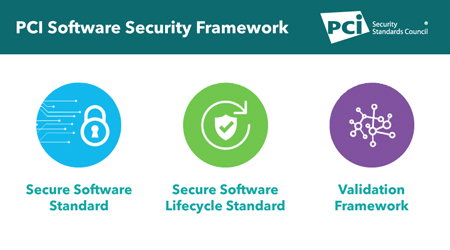

PCI-SSC: Get Your Papers

The Payment Card Industry Security Standards Council (PCI-SSC) has released Version 1.1 of its PCI Secure Software Standard. As part of the PCI Software Security Framework, the Secure Software Standard ensures that payment software is designed, developed, and maintained in a manner that protects payment transactions and minimizes vulnerabilities. Version 1.1 includes the new "terminal software module" for use with payment software intended for devices under PCI-Approved PIN Transaction Security (PTS) Point-of-Interaction (POI).

A pair of previous elements in this PCI Secure Software Standard are its "core module," which includes general security requirements applicable to all payment software, and its "account data protection module," which includes additional security requirements for payment software that stores, processes, or transmits clear-text account data. PCI-SSC expects to introduce additional "modules" in the future. (In the case of the PCI Secure Software Standard, "modules" are groups of requirements that address specific use cases.)

"Software for payment acceptance has changed significantly since the PA-DSS (Payment Application-Data Security Standard) was first developed," acknowledged Troy Leach, SVP Engagement Officer at the PCI Security Standards Council (Wakefield, MA). "The breadth of new development practices to risk-management requires an objective-based approach to define secure software requirements compared to the prior standard. Our security community helped develop this standard that can accommodate the advancements in payment software and accelerate the necessary validation, while continuing to protect payment data against new threats and vulnerabilities." Version 1.1 appears in the document library on the website of the PCI-SSC.

PCI-SCC Roadmap to Secure Payment Software

A Trove of Coin?

It seems inevitable that crypto-currency will significantly impact POS. A latest example: the partnership between POS ISV Ovvi (Stafford, TX) and crypto-currency payment processor CoinPayments (Vancouver, BC, Canada). It allows merchants across retail and hospitality verticals to benefit from low-cost, in-store crypto payments, according to the two parties. Established in 2013, and supporting 2,000 "coins," so far CoinPayments has processed $10 billion in transactions in the U.S.

"A step in the right direction for the payments industry," projected Jason Butcher, CEO at CoinPayments. "[With Ovvi,] we look forward to supporting anyone looking to easily accept crypto-currencies as a form of payment at the POS." As products for the retail environment, CoinPayments offers its shopping cart plug-ins, digital wallets, and APIs (Application Programming Interfaces)--all supporting crypto-currency.

"With the crypto-currency market growing, there is a rising demand for solutions for these payments," confirmed Manan Mehta, CEO of Ovvi, adding "Restaurants and retailers must have solutions to accept crypto-currency. This integration with CoinPayments is a step into the future." Ovvi, the former Possible POS, has also opened its new office in Toronto, Canada. "We are already seeing much success in the Canadian market since entering in January 2021," disclosed Mehta.

A Partnership for Crypto-Currency: Ovvi and CoinPayments

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products

and offers for resellers.

POS & Peripherals

Electronic Payments

Epson America

Harbortouch

HP

Ingenico

Pioneer Solution

POSBANK USA

Posiflex

POS Nation

Revel Systems

Barcode Printers

Bixolon America

Brother Mobile

Godex Americas

Cash Drawers

APG Cash Drawer

Customer Journey and Engagement Management System

FastSensor

Data Collection

CipherLab

Code Corporation

Janam Technologies

Unitech America

Integrated Payment Solutions

Datacap Systems

Electronic Payments

Ingenico

International Bancard

North American Bancard

PAX Technology

Receipt Printers

Bixolon America

Brother Mobile

Epson America

Star Micronics

Woosim Systems

Stands, Mounts, Cradles

Gamber-Johnson

INSTALLATIONS

SBA (and POS) to the Rescue

The U.S. Small Business Administration (SBA) has announced the first round of point-of-sale solution providers participating as facilitators for customers applying for the Restaurant Revitalization Fund: Clover, NCR, Oracle Hospitality, Shopify, Square, and Toast. In order to bring jobs back and revive the industry, the American Rescue Plan established the $28.6 billion Restaurant Revitalization Fund at the SBA. It provides restaurants with funding equal to their pandemic-related revenue loss at up to $10 million per business ($5 million per physical location).

Applications opened on Monday, May 3, 2021. Each point-of-sale partner is helping in different ways, reported the SBA, from providing a fully integrated application experience, to building pre-packaged point-of-sale documentation, to holding educational webinars. In all cases, emphasized the SBA, these partnerships will allow for thousands of restaurant owners to accelerate their application submission process. (In its first two days, the Restaurant Revitalization Fund received nearly 200,000 applications.)

"The SBA is partnering with point-of-sale providers to leverage technology to better reach the smallest businesses that need our help the most," expressed Isabella Casillas Guzman, SBA Administrator. "This collaboration is just one example of the many innovative and creative ways we're connecting with entrepreneurs in the hardest hit and underserved communities." A full list of participating point-of-sale service providers will be continually updated and can be found on the website of the SBA.

U.S. Small Business Administration Opens its Restaurant Revitalization Fund

Canada Loves Donuts

Across the kingdom of donuts in Canada, also known as Tim Hortons, will be new drive-thru outdoor digital menu boards, courtesy of Samsung Canada (Mississauga, ON, Canada). With installations already completed in approximately 1,300 sites, this partnership marks the largest outdoor deployment of such digital signage to date in Canada, according to the two parties. A total of 2,600 sites will be completed by year's end. As integrator: Melitron Corporation (Guelph, ON, Canada).

As hardware, this deployment employs the 55" OH-F Series by Samsung. As integrated in multi-panel outdoor display, it features thin silhouette of 3.3 in./85 mm, built-in power box, and ruggedness of IP-65. A tempered "Magic Glass" protects against vandalism. As screen brightness, there's 2,500 nits and 5000:1 contrast ratio. An anti-reflective surface and auto-bright sensor further customer comfort.

"Tim Hortons' drive-thru network provides Canadians with a fast, contactless way to grab their favorite food and coffee on the go," indicated Chris Main, VP of Restaurant Technology at Tim Hortons. "Samsung technology plays an important role in our vision to modernize the customer experience and we are excited to install outdoor digital menu boards in our drive-thru restaurants." As one of its distributors in our area of focus, Samsung has BlueStar (Hebron, KY).

Tim Hortons Rolls Out Samsung Outdoor Digital Menu Boards Across Canada

Channel Factoid

A Question of QR

-Since the onset of COVID-19, in mid-March 2020, more than four-fifths of consumers, 83%, report using QR Codes to make payments or conduct financial transactions for the first time.

-Almost two-thirds of respondents, 65%, have noticed an increase in places where QR Codes can be used for payments, and almost 9 in 10, 87%, feel secure in using such QR Codes.

-Almost half of respondents, 47%, said they know QR Codes may open URLs. By comparison, only 37% of respondents know that QR Codes may download an application, and only 22% of respondents know QR Codes may identify their physical location.

-In fact, almost one-third of respondents, 32%, said they have scanned QR Codes that did something they were not expecting or were taken to suspicious websites.

Almost half of respondents, 49%, said they either do not have, or do not know if they have, security installed on their mobile device.

Source: "2021 Consumer Sentiment Study," by Ivanti (Salt Lake City, UT).

QR Pay Solution by Shift4 Payments

HELLO GOODBYE

Citizen's New Prez

A new President and CEO for Citizen Systems Japan Co., Ltd. (Tokyo, Japan): Katsutoshi Mukaijima. Previously serving as Senior General Manager of the Printer Products Division and member of the Board of Directors, Mukaijima has helped lead the company's product planning, development, and overall technology roadmap in several prestigious roles globally at the level of Managing Director and General Manager. He began his career in 1989 when he joined Citizen Watch.

"Mukaijima-san has represented Citizen Systems America at a Board of Directors leadership level and is a primary contributor to the great products we offer," commented Norimitsu Kato, President and CEO of Citizen Systems America (Torrance, CA). "We are pleased to have him as President and CEO and to continue to receive the valuable leadership he provides to our products, services, and end-user value. His commitment and vision to the Citizen business and general leadership are valuable assets to us all."

Katsutoshi Mukaijima, President and CEO, Citizen Systems Japan Co., Ltd.

An American VP for ISVs

First American Payment Systems (Ft. Worth, TX) has elevated Chris Yurko to the new position of VP of Integrated Payments. He joined First American in 2018 as Director of Business Development. Earlier, he served as Director of Strategic Partnerships at Worldpay, ISV Manager at Electronic Cash Systems, Payment Integration Specialist at Apriva, and Inside Sales and Merchant Service Specialist at Chase Paymentech.

"Chris has been instrumental in ramping up First American's ISV presence over the past three years," contributed Rick Rizenbergs, EVP of Sales. "He has a proven history of building sales teams and developing exceptional results. His drive, frankness, and follow through represent the best that is First American and will no doubt contribute to the channel's future growth."

Chris Yurko, VP of Integrated Payments, First American Payment Systems

[Editor's Note: In April, First American Payment Systems agreed to be acquired by small business financial services player, Deluxe Corporation (Shoreview, MN). An all-cash transaction totals $960 million. "Our acquisition of First American will enable Deluxe to participate in merchant services," observed Michael Reed, President of Payments for Deluxe. "We expect to offer these merchant services to our thousands of financial institution customers, millions of small businesses, and hundreds of the world's biggest brands through our established and highly effective sales and distribution system."]

PinPoint Media

All Rights Reserved