Michael Kachmar, Editor

(If your e-mail client does not display this properly, click here.)

This Week’s Product Pick

Source Technologies (Charlotte, NC) shipped its ST9622 Multi-Function Printer (MFP), the newest member of its ST9600 MICR/Laser family. Engineered to bring cost-effective on-demand check printing to small businesses and branch offices, the ST9622 offers print speed of 40 ppm (pages per minute), built-in duplexer, 500-MHz processor, and 256 MB of standard memory. Measuring only 19 in. x 17 in. x 21 in., and weighing 50 lbs., the device delivers benefits such as copy, scan, and fax; copy disable, when using MICR toner, to limit exposure to fraud; and optional watermark feature for copy function when using MICR toner. A fuser that warms up instantly and time to first page as fast as 6.5 seconds increase efficiency, according to the vendor, augmented by front-loading supplies, an optional paper drawer, and four-line backlit display for “show me” and “tell me” instructions. In support of its ST9600 product line, Source Technologies also introduced its Forms MICR configuration and conversion tool, which helps end-users migrate to new hardware. “Based on the highly popular ST9620 print engine, the revolutionary ST9622 provides organizations with unprecedented flexibility for their print needs,” commented Kevin Forrester, VP of Sales.

Source ST9622 Printer

COMPANY BUSINESS

Percon Reborn, Phoenix Flies

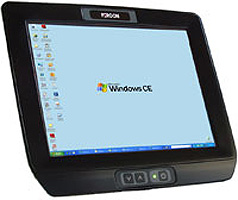

One of the famous names in the Auto ID channel has reappeared with the launch of the new Percon Phoenix 104/104e vehicle-mount industrial computer. Percon, which disappeared after its purchase by PSC, followed in turn by PSC’s purchase by Datalogic, has been revived as an independent entity by veterans of those former companies. Robert Hougen, who played leadership roles in engineering and product marketing, serves as President of the new Percon, and James “Boony” Budniakiewicz, former head of IntelliTrack, an associated ISV, holds the title of VP of Sales and Marketing for Percon.

Although based in Eugene, Oregon, Percon has no affiliation with Datalogic, its principals emphasized during an interview with RRN.Com. It has been formed expressly to address the need for cutting-edge vehicle-mount terminals. “Most manufacturers really concentrate on handheld terminals, and offer vehicle mounts to fill out their product line,” Budniakiewicz suggested. “We’re concentrating on the thing we know best in order to deliver the highest-quality products and to support our client base more effectively.”

Phoenix 104/104e delivers functionality normally found in large vehicle-mount terminals but at a lower price point and smaller size, according to Percon. Key characteristics include 520-MHz PXA270 processor, Microsoft WinCE 6.0 OS, Cisco-compatible 802.11n radio, and an IP-67 rating. The terminal includes 10.4-inch anti-glare touchscreen, the full complement of connectivity ports, browser and terminal emulation, and dual high-volume speakers to support the use of audio feedback or direction. It has been in the hands of select customers and dealers since January, and Percon has now set its sights on broader penetration of the market for manufacturing and warehousing.

Phoenix 104 Vehicle-Mount Computer From Percon

SUMO Enters the Ring

ScanSource (Greenville, SC) has formally opened the doors to SUMO, its online partner matching gateway for VARs, ISVs, and OEMs, which has been in test since Q1. Through Google, SUMO allows its members to seek out potential partners by entering specific search criteria such as geographic location, technology portfolio, or vertical market expertise. In essence, SUMO serves as the search engine for our closed community, according to the distributor. This allows users to access information that is more relevant than the larger search universe can provide. VARs and ISVs pay no fee for the service.

“We are seeing more and more members of our channel explore partnerships as the means to extend their sales and support ‘reach’ and be competitive in more deals and opportunities,” relayed Bobby McLain, VP of Marketing for ScanSource. “SUMO allows VARs to easily explore and broker new relationships that can enhance their offering, taking the networking opportunities typically afforded only at conferences and trade shows and putting it at their fingertips 24/7. Its targeted results allow our customers and vendors to effectively expand their business and create incremental demand for their products and services.”

SUMO supports all ScanSource business units--POS & Auto ID, Security, Communications, and Catalyst Telecom--and all geographies. Providers must be affiliated with the ScanSource channel to be considered. In an interview with RRN.Com in July, Mike Baur, ScanSource’s CEO, emphasized the growing importance of collaboration and partnering to the channel’s success. “Once we’ve created momentum, SUMO will become central to our overall community strategy, which is The Source,” Baur indicated. Stay tuned.

Bobby McLain, VP of Marketing, ScanSource

Worth Your While

NACS Show

National Association of Convenience Stores

October 5-8

Atlanta

CTIA Enterprise & Applications

CTIA-The Wireless Association

October 6-8

San Francisco

Poll-A-Rama

Tri-Technical Systems

October 13-14

Dubuque, IA

Pack Expo International

Packaging Machinery Manufacturers Institute (PMMI)

October 31-November 3

Chicago

AIM Expo

Association for Automatic Identification and Mobility

November 1-3

Chicago

Customer Engagement Technology World

(Formerly KioskCom & The Digital Signage Show)

November 10-11

New York

NRF 100th Annual

Convention & Expo

National Retail Federation

January 9-12, 2011

New York

RSPA Inspire 2011

Retail Solutions Providers Association

January 23-26, 2011

Maui, Hawaii

ProMat 2011

Material Handling Industry of America

March 21-24, 2011

Chicago

PARTNER PROGRAMS

Hooking Up at BlueStar

BlueStar (Hebron, KY) will distribute networking and connectivity products from SIIG, Inc. (Fremont, CA) to its resellers throughout the U.S. and Canada. SIIG’s expansive portfolio includes IT products such as Serial ATA and Ultra ATA controllers, FireWall, USB, and legacy I/O adapters, all of which bridge the connection between computer systems and external peripherals. In the area of A/V and digital signage, it specializes in hardware for the transmission and switching of signals over CAT 5/6.

“BlueStar is excited about our new partnership and channel distribution opportunities with a leading manufacturer like SIIG,” stated Gary Childress, Director of Digital Signage Solutions at BlueStar. “With a full product line of IT and A/V connectivity solutions, SIIG is the perfect fit for our value-added approach to providing product bundles and end-to-end solutions.” BlueStar will add SIIG’s products to its digital signage bundled solutions and professional A/V packages, which now include commercial panels, media players, mini-PCs, flat-panel TVs, mounting solutions, and network extenders, in addition to content management software.

Added Mike Woodmansee, SIIG’s Director of Sales and Marketing, “Our relationship with BlueStar gives us the opportunity to expand our presence with digital signage connectivity products to BlueStar’s unique base of POS resellers. BlueStar is a leading global distributor and we are very pleased to have them as part of our distribution family.” SIIG products can be found in many computer retail stores, mail order catalogues, and e-commerce sites, as well as through major distributors, system integrators, and VARs.

SIIG Offers IT, A/V, and Digital Signage Network Products

Your Monthly Avalanche

Wavelink Corporation (Midvale, UT) has officially introduced Avalanche Managed Services, which eliminates the need for end-users to administer their own wireless network. Under the new program, which can be sold through resellers, Wavelink will set up, configure, and monitor Wavelink Avalanche in the MSP model, based on monthly subscription rates. Using the Avalanche console, Wavelink will remotely manage each subscriber’s mobile devices, including security configurations, software packages, and other operational settings. Wavelink’s plans in this area were first revealed to the industry by RRN.Com in August, along with its support for popular smart-phone platforms.

“Most companies recognize the importance of managing their fleet of mobile devices, but they just don’t have the resources or expertise to keep up with the rapid growth in the number of mobile devices within their organization,” noted Peter Cannon, Senior Product Manager at Wavelink. “With Avalanche Managed Services from Wavelink, they now have an easy way to ensure that each device is proactively managed so it runs efficiently, remains secure, and maintains compliance with security regulations.”

Avalanche Managed Services can be tailored to fit the customer’s specific needs. Offerings include implementation services, provisioning, updates for devices, help-desk support, and reporting and analysis. Security features include digital certificates and authenticated log-ins. Both local and wide-area wireless network management can be addressed for customers, from LAN to WAN, in other words.

Peter Cannon, Senior Product Manager, Wavelink

Join the Party at No Charge

Do you need to reach the POS & Auto ID resellers who really drive business—in the most targeted editorial environment, and on the most cost-effective basis?

E-mail Michael

Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry ! Use the links below to catch up :

ALL IN THE FAMILY

NetPro Fashioned by APG

APG Cash Drawer (Minneapolis) presented its NetPro Ethernet cash drawer interface for thin-client POS, which carries its own network IP address for real-time reporting of cash drawer status and events. Two configurations have been developed--NetPro 480 with an external power supply and NetPro 490 with Power-over-Ethernet--in order to support the APG Series 4000 and Series 100 cash drawers, RRN.Com was told by Robert Daugs, Business Development Manager for APG. According to Daugs, this is the first time such an interface has been brought to cash drawers.

By deploying cash drawers as free-standing devices with event-tracking, several benefits are extended to end-users. First, remote help-desk support can be provided for service and trouble-shooting of cash drawer operation in distributed retail locations. Second, time and date-stamped access to cash furthers efforts to monitor employees and control shrink. Lastly, historical cash drawer performance data enables better utilization of store assets, all the way from the cash drawer to the POS terminal itself.

APG is currently rolling out its first major installation of the new technology. As target markets for NetPro, Daugs points in particular to convenience stores and quick-service restaurants, which typically run long hours with minimal supervision. Most likely, larger retail customers will be best positioned to take advantage of NetPro’s intelligence-gathering capabilities, he added.

An Ethernet Interface for Your Cash Drawer

Step into Liquid

Cognex Corporation (Natick, MA) debuted its next-generation handheld industrial scanner, the DataMan 8000 Series. Designed for the factory floor, the new devices leverage proprietary 1DMax and 2DMax decoding algorithms for reading virtually every type of barcode, according to the manufacturer, as well as innovations such as modular, upgradeable communications (RS-232, USB, and Ethernet) and liquid lens variable focus technology. Already integrated into the company’s fixed-mount readers, liquid lens capability delivers maximum flexibility for depth of field in image-based reading.

DataMan 8000 comes in two models, denominated 8500 and 8100. DataMan 8500 utilizes the company’s UltraLight technology for superior image capture on any mark type and surface. UltraLight provides dark field, bright field, and diffuse lighting all in one electronically controlled source. DataMan 8100 concentrates on bright field illumination for applications that require superior code reading performance without specialty lighting.

“The DataMan 8000 Series represents our breakthrough for industrial handheld readers,” declared Carl Gerst, Business Unit Manager for ID Products at Cognex. “In addition to its powerful code-reading capability and rugged design, the DataMan 8000 Series communicates easily with factory networks and ERP systems for real-time traceability, and the automatic variable focus enables operators to use the system close up for very small, two-dimensional, direct part marks and at greater distances to read longer, one-dimensional barcodes.”

Next-Generation Handheld Imager From Cognex Corporation

Code Corner

Fifth Third Processing Solutions (Cincinnati) launched PCI Assist, aimed at Level 4 merchants looking for guidance as they pursue compliance with the Payment Card Industry Data Security Standard (PCI DSS). Specifically, PCI Assist provides small merchants with access to the TrustKeeper web portal from Trustwave (Chicago). Using its dynamic PCI Wizard in conjunction with TrustKeeper Agent, and simple terminology, TrustKeeper helps merchants complete the PCI Self-Assessment Questionnaire, schedule required vulnerability scans, and receive their PCI DSS compliance certificate. Other components of PCI Assist from First Third include access to Security Policy Advisor and Security Awareness Education to ensure merchants have addressed business operation requirements such as PCI DSS Requirement 12. “Many small merchants often lack the technical expertise and resources to ensure their environments are properly secured and compliant,” said Doug Klotnia, EVP of Product and Strategic Sales at Trustwave. “Fifth Third Processing Solutions has created a comprehensive program that supports their merchants with easy-to-navigate tools that facilitate compliance. We’re excited to be a part of this program as our technology was created for these types of merchants.”

[Editor’s Note: Along similar lines, First Data Corporation (Atlanta) has announced the public availability of its TransArmor card security solution, following successful pilot testing. TransArmor utilizes encryption and tokenization--based on SafeProxy architecture from RSA, the Security Division of EMC--and will be brought to market through First Data’s extensive network of resellers.]

INTEGRATION

A Double Shot of Mobility

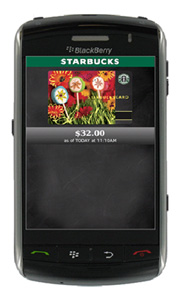

Customers with the BlackBerry Curve, Storm, or Tour may now take care of all their coffee habit through the complimentary Starbucks Card Mobile App, released this month. It follows the introduction of this app for iPhone and iPod from last September. All of the following functionality has been addressed: checking card balance, reloading funds from any major credit card, paying for purchases, finding nearby stores, and checking rewards status. So far, the mobile payment feature applies to 1,000 Starbucks in U.S. Target stores and 16 trial stores in Seattle and Northern California.

Such mobile applications build on the runaway success of the Starbucks Card program, according to the retailer. It’s expected that customers will load more than $1 billion on Starbucks Cards this year. Indeed, nearly one in five transactions taking place in U.S. Starbucks stores now get paid through the Starbucks Card. Additionally, the My Starbucks Rewards program continues to grow with over one million gold-level members to date. To earn this status, customers must receive 30 stars representing purchases made over 12 months.

“Expanding our mobile footprint gives our customers another way to connect with Starbucks on the go and transforms the way our customers see and use their Starbucks card,” observed Brady Brewer, VP of Starbucks Card and Loyalty (Seattle). “Launching the Starbucks Card Mobile App for BlackBerry smart phones opens up mobile payment and other features to a new group of our customers, and is the next step in our continued mobile expansion.”

Starbucks Card Mobile App for BlackBerry

[Editor’s Note: We’re not sure if POS VARs should be intrigued or terrified by these developments.]

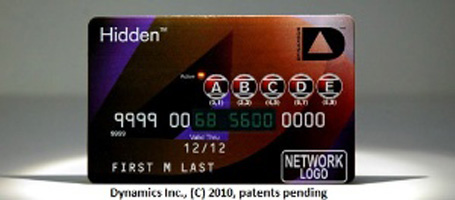

Will MSR 2.0 Be Programmable?

An interesting start-up, Dynamics, Inc. (Santa Clara, CA), has unveiled Card 2.0, which it deems the next evolution of payment technology due to its fully card-programmable MSR, or “Electronic Stripe.” The device itself can change any bit of information on this programmable stripe at any given time, according to Jeff Mullen, Founder and CEO at Dynamics, which recently received $5.7 million in financing led by Adams Capital Management after operating “in stealth mode” over the past three years. According to Mullen, the card works with any existing POS device in the market. Moreover, it’s designed to be as thin, flexible, and durable as traditional payment cards and to last over three years on its single battery charge.

Two Payments 2.0 applications were demonstrated at this week’s DEMO Fall 2010 in Silicon Valley. In the first, termed “multi-account,” two buttons are featured on the face of the card. Each button correlates to its printed account number and light source. A user may select an account by pressing one of the buttons, upon which the card visually indicates the choice by turning on the associated light. Necessary information gets written to the MSR through Electronic Stripe and the card can then be swiped.

The second configuration, “hidden,” carries five buttons on the face of the card. To utilize this device, the user must enter his or her personal unlocking code into the card, which will then visually display the payment card number. Once again, the MSR gets populated with the correct information and the card can be used. In this case, the display shuts off and the MSR erases itself after an interval, thus removing all critical customer data and rendering the card worthless to thieves.

“Dynamics has disrupted the payment ecosystem without disrupting the payment infrastructure--and introduces extreme consumer value in the process,” maintained Joel Adams, Founder, Adams Capital Management. “The technology breakthrough is unprecedented. By simply upgrading their cards, large issuers can now upgrade their magnetic-stripe infrastructure.” New opportunities will follow in areas such as fraud reduction, customer loyalty, and money management, according to the two parties.

New Payment Cards Leverage Electronic Stripe Technology

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products and offers for resellers.

POS & Auto ID Distribution

BlueStar

ScanSource

POS & Peripherals

Logic Controls

Pioneer POS

Posiflex Business Machines

POS-X

POS Systems - Hospitality

PAR

Barcode & Mobile Printers

Datamax-O'Neil

Godex International

Barcode & Transaction Printers CognitiveTPG

Cash Drawers

APG Cash Drawer

MMF POS

Data Collection Terminals

Datalogic

Mobile

Janam Technologies

Data Collection Software

Wavelink

Integrated Payment Solutions

Datacap Systems

Keyboards

Cherry Electrical Systems

Receipt

Printers

Bixolon America

Citizen Systems America

Epson America

Star Micronics

Screen Protection

3M Optical Filters

Video Surveillance & Access Control

ScanSource Security

INSTALLATIONS

PAR Eats and Drinks of QSR

ParTech (New Hartford, NY) announced it has fielded its newly developed EverServ QSR POS software into two different quick-service restaurant concepts, franchised burger and independent coffee house, thereby demonstrating the flexibility and scalability of the solution. PAR launch partner S.L. Investments, CKE franchisee, implemented EverServ QSR in its Carl’s Jr. in Las Vegas, and plans to roll out the platform to 37 of its sites by the end of the year. SIP Coffee House, a single-unit operator in San Antonio, Texas, has also successfully deployed EverServ QSR. In both cases, PAR’s EverServ 6000 terminals run the solution and ConnectSmart Kitchen software from QSR Automations (Louisville, KY) handles the order fulfillment process.

“The new PAR EverServ QSR POS system has significantly improved our speed of service,” reported Bill Thorson, Director of IT, S.L. Investments. “The conversational ordering feature allows us to process meals much more quickly, and the ease by which we can integrate external ordering capability gives us powerful access to new features like line busting. We are impressed with both the robust customer service features of EverServ QSR and the strength of its enterprise management capabilities.”

Meanwhile, Precidia Technologies (Ottawa, Canada) said its TransNet payment technology now works with the PAR Exalt POS system--popular in QSR--to process fully integrated gift card payments, thus eliminating the need for stand-alone payment terminals. “This solution makes it easier for us to process gift card transactions and avoid double-entry errors,” testified Charles Singer, CFO of RC&W, Inc., Dairy Queen franchisee also located in Las Vegas. “And the ability to close batches and perform settlement tasks with MerchantVu cuts down on our administrative burden.”

Carl’s Jr. Deploys EverServ POS System

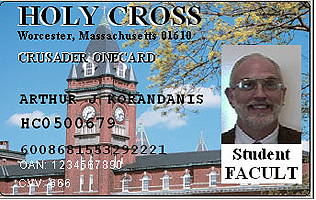

4,000 Card Crusade

College of the Holy Cross (Worcester, MA) has selected Campus Solutions by Heartland Payment Systems (Princeton, NJ) as its new on-campus prepaid card platform. Further, Holy Cross, as the school is more commonly known, will implement its first off-campus payment program through Heartland’s Give Something Back Network, which incorporates automatic charitable donations as part of its methodology. In all, Holy Cross plans to issue more than 4,000 cards to new and returning students, faculty, and staff.

With the Crusader OneCard (named for the school’s totem), students will be able to buy books, make copies, pay for laundry, and access dining services and vending machines. As part of the Give Something Back Network, Crusader OneCard also allows students to use their IDs as prepaid, FDIC-insured cards at participating merchant locations off-campus. Such merchants pay reduced fees for processing transactions made with the Crusader OneCard, according to Heartland. Under OneCard, some predefined percentage of the purchase price of goods, 1.5% typically, gets donated to the sponsoring school for its general fund or individual designation.

“Heartland’s platform offers students more integrated and convenient services for our Crusader OneCard program,” commented Art Korandanis, Director of Auxiliary Services for Holy Cross. “The Crusader OneCard will help support the local economy by providing merchants with this unique way to grow their business.” In addition to its standard format, OneCard can also be supplied as an adhesive-backed contactless tag attached to the student’s mobile device.

Holy Cross OneCard Powered by Heartland Payment Systems

Channel Factoid

Perhaps the buzzwords should be “cautious optimism.” According to the second annual retail outlook study from CIT Group, 65% of retailers and 69% of suppliers believe consumer spending may return to 2007 levels by the end of 2011. Six in ten retailers say that over the last 12 months their revenues have grown (55%) or grown significantly (5%), and two-thirds expect revenues to be higher still in the coming 12 months. At the same time, nearly 60% of respondents describe their current inventory as higher than it was one year ago. At the same time, they’re quick to reduce prices to speed their inventory turns, and they’re depending on technology to track demand and purchasing more closely, according to this study. Over the next 12 months, 83% of retailers expect to make greater investments in their websites, 69% say they will increase their stake in mobile applications, and 66% will boost spending for integration of in-store and technology-enabled channels. “Some valuable lessons have been learned from the economic crisis and many suppliers believe they are better positioned for strong and sustained growth once the economy turns,” remarked Jon Lucas, EVP and Chief Sales Officer of Trade Finance at CIT. “This study reveals an industry that is transforming, top to bottom.”

HELLO GOODBYE

Crotty Finds NetEnrich-ment

NetEnrich (San Jose, CA), an up-and-coming IT SaaS provider, has engaged Justin Crotty as its SVP and GM. Crotty previously found success as VP of Services for Ingram Micro North America--where he helped pioneer the IT channel’s first distributor-offered managed services suite--as well as VP of Channel Marketing. At NetEnrich, he will be responsible for sales, marketing, and product development, which entails growing the company’s channel partner ecosystem throughout North America and Europe.

“Justin has a proven track record built on more than 20 years in the IT channel,” stated Raju Chekuri, CEO of NetEnrich. “His leadership of the ground-breaking development of Ingram Micro’s Services Division and Ingram Micro Seismic proves he not only understands the IT services business strategy for the channel, he understands how to build upon our vision for growth. We’re excited that he set his sights on NetEnrich for the next chapter in his career. His experience, coupled with our expertise, will enable IT channel partners to succeed with cloud computing and managed services today, and pave the way for mutually profitable growth for our partners and NetEnrich well into the future.”

“There’s a great deal of opportunity for channel partners to increase their operating income and profitability with managed IT services,” Crotty professed. “Our aim is to make it easier for VARs to get into this business and for MSPs to break out with new integration, consulting, and high-margin service engagements which positions them as the virtual CIO and technology advisor to the clients they serve.”

Justin Crotty, SVP and GM, NetEnrich

[Editor’s Note: On its part, Ingram Micro has announced the appointment of Renee Bergeron as its new VP of Managed Services and Cloud Computing for North America. Bergeron joins Ingram Micro from Fujitsu America, where she led its $300 million IT services business. Prior, she headed U.S. operations.]

PinPoint Media

All Rights Reserved