Michael Kachmar, Editor

(If not displaying properly or banners not loading, click here.)

Our Product Pick

An "AI Intelligence Suite" has been debuted by PAR Technology (New Hartford, NY). It flows across the vendor's restaurant tech stack, spanning point-of-sale, payments, drive-through, loyalty, and back-office. An initial function, "Coach AI," guides users of the restaurant management platform, PAR OPS. A fellow module, "AI for Marketers," will follow. "PAR AI marks a turning point in how we serve our customers," relayed Savneet Singh, CEO of PAR. "We're going AI native, embedding it into everything we do. It's not about building tools anymore--it's about owning the workflows to drive new outcomes."

PAR Goes AI Native

COMPANY BUSINESS

A Day in Boca

Another consolidation in the channel of POS/Payments, with TouchSuite (Boca Raton, FL) taking the majority stake in the Systems Technology Group (Buffalo, NY). A longtime VAR in POS, since 1996, STG serves merchants in the U.S. and Canada. It will continue to operate independently under its current leadership, according to TouchSuite, with no immediate changes made to branding, product offering, or customer engagement processes. Established in 2003, TouchSuite provides integrated payment solutions, capital access, and business automation tools for the SMB.

"We're thrilled to welcome the STG team into the TouchSuite family," shared Sam Zietz, CEO of TouchSuite. "STG has built an incredible reputation for delivering operational excellence, deep industry expertise, and a POS platform that truly understands the needs of restaurants, retailers, and franchise operators. Together, we'll unlock new opportunities for growth, including capital investment, cross-selling strategies, and future product enhancements."

"We are incredibly excited to partner with the TouchSuite team," contributed Gary Kielich, President of STG. "By combining our nearly three decades of POS expertise with TouchSuite's leadership in kiosk technology [through sister company of TouchSuite, Grubbrr, also led by Zietz] and payment integration, we can broaden our solutions and deliver even greater value to customers throughout North America." As partners, STG has NCR Aloha, Retail Management Hero, and SpotOn.

Sam Zietz, CEO of TouchSuite, Now With Majority Stake in the Systems Technology Group

Embarking on TREK

A new family of touchscreen computers, entitled TREK, has been unwrapped by Custom America (Boothwyn, PA). Addressing formats in POS, Self-Service, and KDS (Kitchen Display System), it offers choice of three projected-capacitive, true-flat display sizes--15.1", 15.6", 21.5"--as well as options in motherboard--x86 with Intel CPU, ARM with MediaTek CPU, and Scaler. It supports cloud-based or thick-client environments, running Windows, Android, Linux, or Chrome OS.

A full suite of ports accompanies all models of TREK, including USB Type-A, USB Type-C, RJ-45 LAN, RJ-48 Serial, and RJ-11 Cash Drawer. Addressing durability, it features fanless design, robust housing, and rating of IP-54 for water and dust protection. Added features include simplified cable management, easy service, and three-year warranty.

"Since all models of TREK share modular architecture, you can easily mix and match and re-purpose your systems within your business," emphasized Dave Murphy, VP and Head of Global Product Marketing at Custom America. "Software development and hardware maintenance are greatly simplified, eliminating the need to have one support plan for point-of-sale terminals, another for kiosks, and yet another for price look-up or service desk workstations." All necessary peripherals and accessories may be supplied by Custom America.

Custom America Ships TREK POS

Worth Your While

Pack Expo

PMMI-Association for Packaging

and Processing Technologies

September 29-October 1

Las Vegas, NV

Money 20/20 USA

Ascential PLC

October 26-29

Las Vegas, NV

MJBizCon

Emerald X

December 2-5

Las Vegas, NV

2026

NRF Big Show

National Retail Federation

January 11-13

New York, NY

NGA Show

National Grocers Association

February 1-3

Las Vegas, NV

RSPA Inspire

Retail Solutions Providers Association

February 1-4

Kaua'i, HI

ETA Transact

Electronic Transactions Association

March 18-20

Atlanta, GA

ALL IN THE FAMILY

It Packs RFID

A processor with fully integrated UHF (RAIN) RFID has been produced by Qualcomm (San Diego, CA), and stocked as Dragonwing Q-6690. In addition, for further enterprise mobility, it incorporates state-of-the-art wireless: Bluetooth 6, Wi-Fi 7 WLAN, and 5G WWAN. In eliminating the need for external readers of RFID, and available with or without modem, it enables smaller, lower-power device designs, explains Art Miller, VP and Head of Retail for Qualcomm.

A combination of Octa-Core CPU at 2.9 GHz (Qualcomm Kyro), powerful GPU (Qualcomm Adreno 7), and dedicated engine for AI (Qualcomm Gen 3) delivers up to 6 TOPS (Tera Operations per Second) for Dragonwing Q-6690. As "enterprise-ready," for I/O, it furnishes 2x PCIe, USB 3.1 with eUSB 2, and eMMC 5.1. An individual package, i.e., non-stack, measures 14 x 12 x 0.89 mm (approximately 0.6" x 0.5" x 0.04").

Also, Dragonwing Q-6690 introduces so-called feature packs that let OEMs (Original Equipment Manufacturers) and ODMs (Original Design Manufacturers) choose their offerings based on the computing demands, multimedia capabilities, camera support, and/or peripheral configurations they need--with the ability to upgrade over the air with software. A modular approach--befitting use in ruggedized handhelds, kiosks, and POS--accelerates time to market and reduces certification overhead, continued Art Miller at Qualcomm. As early adopters of interest to our readers: CipherLab, Honeywell, Zebra.

New Qualcomm Enterprise Mobile Processor With Both RFID and Wireless

Janam's Face Time

A bundle of biometric facial authentication for access to ticketed events has been fashioned by Janam Technologies (Woodbury, NY). It draws upon the software of Wicket (Cambridge, MA), in support of Janam's XT4 Rugged Mobile Computer and GTX Mobile Entry Pedestal. It adds biometrics to barcode scanning (Honeywell 1D/2D N5703), NFC (Apple Wallet/Google Wallet), and QR Codes (16 MP/8 MP Cameras) in XT4.

"Anyone taking a flight these days knows that face biometrics is growing swiftly as a reliable means of access control," noted Harry Lerner, CEO of Janam Technologies (now part of HID). "We are delighted that our new XT4 supports Wicket's robust facial authentication platform for venue access, expanding what our customers can do with a single device and future-proofing them for approaching technology trends. Especially when powering our super-affordable mobile pedestal, XT4 is the most cost-effective and versatile way for venue-access customers to rapidly deploy hardware that supports the world's leading authentication and ticketing platforms."

With 6" sunlight-readable capacitive touchscreen display, the XT4 weighs 10.5 oz./300 g. It features Qualcomm Dragonwing Octa-Core CPU at 2.7 GHz, 8 GB/128 GB Memory, and Android 14 O/S with GMS (upgrade to Android 18 O/S). A full suite of wireless includes Bluetooth 5.2/BLE, Wi-Fi 6E WLAN, and 5G/Private LTE WWAN. A rechargeable and hot-swappable 5200 mAh Li-ion battery powers long work shifts.

Janam Adds Facial Authentication by Wicket

Join the Party at No Charge

|

|

|

|

|

|

||

|

|

||

|

|

|

|

|

|

||

Do you need to reach the POS & Auto ID resellers who really drive business? With the most targeted editorial environment, and on the most cost-effective basis?

E-mail

Michael Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry! Use the links below to catch up:

Retail Product Digest -- Summer 2025

A Message From the Editor

As we enjoy another year--our 20th!--our mission remains constant: to fill the need for timely, focused, non-biased news in the channel for POS & Auto ID (and now Mobility). If anything, that need grows more pressing in the face of new technologies, go-to-market strategies, business models, and consumer expectations. We look forward to continuing our mission, and welcome your suggestions and thoughts on improvements.

Michael Kachmar, Editor

ALLIANCES

Salsa Dancing at Dejavoo

A new certification in payments combines the restaurant management platform by Salsa POS (Houston, TX) with payment technology by Dejavoo (Mineola, NY). It ensures consistent use across multiple terminal types from Dejavoo, including handheld (Model P8), countertop (Model P1), multi-function (Model P18), and wireless (Model QD2). For VARs, ISVs, and ISOs, Dejavoo offers its omnichannel gateway, dubbed iPOSpays, and this hardware based on Android O/S.

"This collaboration opened our eyes to new innovation opportunities in the payment space," reported Chris Lopez, COO of Salsa POS. "The Dejavoo team consistently provided access to the latest devices and functionalities, making it possible to test and refine Salsa's compatibility across their product line. Advancements [in payment terminals of Dejavoo] have allowed us to rethink how restaurants operate with Salsa POS."

"We're proud to partner with Salsa," expressed Serena Smith, Director of ISV Channel Development at Dejavoo. "Their team took a holistic approach, using our full suite of APIs (Application Programming Interfaces) and SDKs (Software Development Kits) to build a robust, ready-to-deploy solution." It's in the DV Store, marketplace of Dejavoo.

An Integration Between Salsa POS and Dejavoo

[Editor's Note: Also added at Dejavoo: EVS Age Verification App.]

Onosys Fills Ecosys

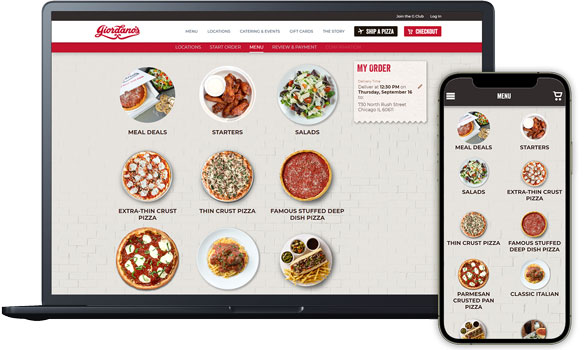

Another group of third-party technology partners has been welcomed by digital restaurant ordering pioneer, Onosys (Independence, OH). It includes: Qu and Cluster in POS; Fishbowl and Incentivio in Loyalty; Cartwheel and First Delivery in Delivery; and, in Payments, Shift4. It increases to 60 the number of such third-party partners for Onosys.

"Integrations have always been at the heart of what makes Onosys different," declared Chris Anderle, President of Onosys (not to be confused with competitor, Olo). "Restaurants shouldn't have to compromise on their technology choices. With our growing ecosystem of partners, we're giving brands the ability to scale faster, deliver richer customer experiences, and remain agile."

As provider of a single integrated platform--spanning ordering via web, mobile app, or call center--Onosys seeks to simplify operations for customers while opening new revenue opportunities. Started in 2003, it serves chains such as Pizza Ranch, Giordano's, Mr. Hero, Jack's Family Restaurants, and Rudy's. In Android O/S, it appears on Google Play.

Onosys Adds More Third-Party Technology Partners

Code Corner

A Charge to SoftPOS

A partnership between Charge Anywhere (Piscataway, NJ) and Nexgo (Laguna Hills, CA) sets forth hardware-free payments/EMV. A turnkey solution, in "SoftPOS," it employs MPoC-certified Tap-to-Phone by Nexgo with QuickSale by Charge Anywhere. It allows end-users--in particular, micro-merchants, gig-economy businesses, and mobile service providers--to accept contactless payments/EMV on commercial devices running Android O/S. Developed by the Payment Card Industry Security Standards Council (PCI SSC), MPoC (Mobile Payments on COTS, or "Commercial Off-the-Shelf") enables direct entry of PIN (unlike earlier solutions of Tap-to-Phone). "Our collaboration with Nexgo delivers what the U.S. payments ecosystem has been waiting for: a secure, MPoC-certified, very-low-cost EMV payment acceptance solution that's ready to deploy at scale," suggested Paul Sabella, CEO of Charge Anywhere.

QuickSale Adds Tap-to-Phone

At the BodegAi

Addressing retailers in SMB, BodegAi POS (New York, NY) has entered into distribution via payment provider SignaPay (Irving, TX). In order to facilitate start-up, BodegAi currently comes in over 12 languages and preloaded with more than 200,000 of the most sold retail SKUs (Stock Keeping Units). With this relationship, it includes SignaPay's PayLo Dual Pricing. An engine with AI offers real-time inventory suggestions, customer behavior analysis, and automated sales reporting--above and beyond POS. As part of the national rollout, qualifying SignaPay Partners are eligible to place BodegAi POS free of charge to merchants. "This is the most intelligent and accessible POS solution we've ever brought to market," proclaimed Matt Nern, EVP and CRO at SignaPay.

BodegAi POS Brings PayLo Dual Pricing

ENVIRONMENTS/PLATFORMS

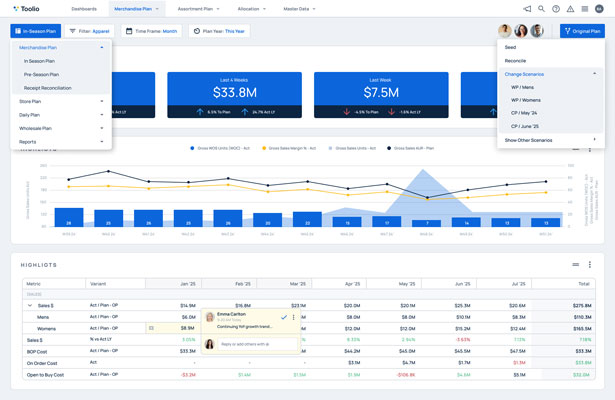

AI Tunes Up With Toolio

An advance in the use of AI, as well as Machine Learning (ML), for merchandise planning in retail has been engineered by Toolio (New York, NY). As participant in the Microsoft Start-Ups Pegasus Program, Toolio now appears on the Azure Marketplace and Microsoft AppSource. A cloud solution, it covers functions spanning demand forecasting, buying management, assortment/allocation, and financials.

With integration to Microsoft Dynamics and Microsoft Power Bl, Toolio draws data from sales, inventory, product descriptions, purchase orders, receipts, and transfers in real-time. Once finalized, decisions and plans are seamlessly exported back to the ERP (Enterprise Resource Planning). Advanced features via AI and ML include clustering stores and products for regional planning, promotion and markdown optimization, business reviews with OpenAI, and exception alerts.

"Retailers are navigating increasing complexity across channels and inventory," reflected Tom Davis, Partner at the Microsoft Start-Ups Pegasus Program. "Toolio's AI-powered platform gives retailers the visibility and insights needed to optimize inventory and drive smarter decisions. Through Pegasus, Toolio can now leverage the resources of Microsoft to scale its impact and help retailers operate with greater efficiency and confidence." As customers, Toolio lists Boll & Branch, MeUndies, Magnolia, and Rothy's.

Next-Generation Merchandise Planning Via Integration of Toolio Platform and Microsoft ERP

A Hungry Heart at Fiserv

A move into hospitality for financial services behemoth Fiserv (Milwaukee, WI) with the purchase of CardFree (San Francisco, CA). An all-in-one platform for customized order, pay, and loyalty, CardFree will be integrated into both Clover and Commerce Hub by Fiserv, with added capabilities such as drive-through, self-service kiosk, and delivery services. Financial terms of the transaction were not disclosed.

"Acquisition builds on the strong foundation Clover and CardFree have created through our work together and positions us to further expand Clover's capabilities across the hospitality, restaurant, and lodging industries," commented Takis Georgakopoulos, COO at Fiserv. "Integrating CardFree's technology into Clover enhances our platform's scalability and flexibility, empowering hospitality businesses to drive growth." According to industry figures, CardFree currently serves 21,000 locations in this target vertical of hospitality.

"An incredible opportunity for the CardFree team," enthused Jon Squire, Founder and CEO at CardFree. "Having collaborated closely with the Fiserv team, I'm confident we're uniquely positioned to address the growing needs of hospitality operators with a best-in-class suite of tools that streamline operations and elevate guest experience." As readers may recall, CardFree emerged from Starbucks and Dunkin' Mobile Apps.

A Push Into Restaurant, Lodging, Hospitality

[Editor's Note: Another strategic move in payments has Electronic Payments, Inc. (Calverton, NY) extending its footprint into Europe--as well as "developer-first" APIs (Application Programming Interfaces)--via acquisition of Handpoint (Rochford, England, UK and Palo Alto, CA).]

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products

and offers for resellers.

POS & Peripherals

Advantech-Aures

Bixolon America

Custom America

Electronic Payments

Epson America

FEC POS

HiStone

HP

Ingenico

POSBANK USA

Posiflex

Sam4s/Shin Heung Precision

Star Micronics

Touch Dynamic

Barcode Printers

Bixolon America

Brother Mobile

Epson America

Woosim Systems

Cash Drawers/Cash Handling

apg/APG Cash Drawer

Data Collection

Star Micronics

Integrated Payment Solutions

Aurora Payments

Charge Anywhere

Datacap Systems

Electronic Payments

Ingenico

Receipt Printers

Bixolon America

Brother Mobile

Epson America

Star Micronics

Woosim Systems

Remote Device Management

42Gears

Canopy

Stands, Mounts, Cradles

apg/APG Cash Drawer

Star Micronics

INSTALLATIONS

Actual Bean Counting

As part of its menu and service recalibration, Starbucks has deployed automatic inventory counting technology from NomadGo (Redmond, WA). A combination of computer vision, 3D spatial technology, and augmented reality, with AI, the system works with handheld devices and tablets. It will be rolled out for all 11,000 company-operated stores in North America by the end of September, according to Starbucks.

A faster inventory counting (up to 8x), with 99% accuracy (versus typical accuracy of 80% to 85%), readily identifies what's available, flags low-stock items, and soon, will even automate restock orders for Starbucks. On its most recent earnings call, Starbucks CEO Brian Niccol said that stock-outs were unacceptably high, and will be addressed. In addition, after first reducing its menu earlier this year, the chain has added new choices.

"A strong validation of our patented technology," in the words of David Greschler, CEO at NomadGo. "It not only streamlines inventory management but also delivers frequent, highly accurate data that prevents out-of-stock situations, and lowers cost of goods sold. Businesses can now match supply to demand with unprecedented precision." As project lead at Starbucks: Deb Hall Lefevre, CTO.

Starbucks Employs NomadGo Inventory AI

A Run on Payments

A new partner-centric payments platform has been launched by newcomer Run Payments (Philadelphia, PA). As Run Merchant, it seeks to unify functions of payments, reporting, and dispute management. It connects seamlessly to leading gateways and processors--including Fiserv, TSYS, CardPointe, Payroc, and iStream--for both cards and ACH.

"Run Merchant is about making payments simple again," indicated Rob Nathan, Co-Founder and CEO at Run Payments. "Too often, businesses, and the partners who support them, juggle multiple processors, gateways, and reporting tools. Run Merchant brings everything together in one orchestrated view, so they can act faster, resolve issues in real-time, and focus more on growth."

As core solutions, Run Payments, which addresses VARs, ISVs, and ISOs, offers its Run Partner, Run Merchant, and Run Developer. As early customers for Run Merchant, it cites firms as diverse as Echo Global Logistics (Chicago, IL) and Power Home Remodeling (Edison, NJ). Prior to launching Run Payments in 2022, Rob Nathan served as Head of Integrated Payments at Fiserv, First Data Corp., and CardConnect.

A Unified, Partner-Centric Platform, Says Run Payments

Channel Factoid

Happy Hour

(Adoption of Key Technologies

in Bars, Taprooms, Breweries)

71% - Use Handheld POS

59% - Higher Tabs with Handheld POS

66% - Improved BOH via Handheld POS

63% - Upsell Prompts on Handheld POS

66% - Offer Contactless Payments

61% - Higher Tips with Contactless

72% - Employ Digital Inventory System

64% - Inventory Integrated with POS

62% - Loyalty Integrated with POS

54% - Replaced Multiple Legacy Systems

With Single Integrated Platform

Source: "Raising the Bar" by Starfleet Research, Funded by Square

A Thirst for Mobility

Short Takes

-Worldpay (Cincinnati, OH) will continue as the exclusive provider of embedded payments for dental software, Henry Schein One, with 75,000 installs in North America.

-Reborn Coffee, with 12 stores in Southern California, will pilot acceptance of crypto-currency payments as part of its POS.

-Signature Systems, Inc. (Warminster, PA), in partnership with eConnect, has completed facial recognition and video surveillance security integrated with POS for Jake's 58 Casino (Islandia, NY).

-PAR Technology (New Hartford, NY) will supply its PAR POS and PAR Hardware for chain Taco Bueno, with 140 locations in OK, TX, and KS.

HELLO GOODBYE

Tally the Votes

Announced at RetailNOW Show, 2025 Vendor Awards of Excellence, as Chosen by Members of the Retail Solutions Providers Association (RSPA)

Hardware - Gold: Touch Dynamic and Epson America (Tie); Silver: Hanasis; Bronze: WTIwireless; Honorable Mentions: Datalogic and PAX Technology. Hardware & Software - Gold: Cash Register Sales (CRS); Silver: iPOS Systems (Dejavoo Systems); Bronze: Toshiba Global Commerce Solutions. Software - Gold: OrderCounter; Silver: NCC; Bronze: EdgeServ POS; Honorable Mentions: Tonic POS and SpotOn.

Electronic Payments - Gold: Datacap Systems; Silver: CoCard; Bronze: Bold Integrated Payments. Distributor - Gold: M-S Cash Drawer; Silver: BlueStar; Bronze: ScanSource. Reseller Support Services - Gold: Card Market; Silver: Washburn Computer Group; Bronze: eCard Systems.

Retail IT Community Leadership - Distributor: BlueStar; Vendor: Star Micronics; ISV: OrderCounter. H.O. Whistler Award - Terry Zeigler, Datacap Systems. W2W Leader - Sandee Finley, Paysafe. RSPA Lifetime Member - Linda Sudderth, formerly Epson America. RSPA Hall of Fame - Brad Holaway, from the former Copperstate Restaurant Technologies. RSPA Board of Directors - New Reseller Members: Thomas Greenman, Skurla's POS Solutions and Paul Leduc, Globe POS. New Vendor Members: Whitney Gerrety, Touch Dynamic and Ashley Naggy, OrderCounter.

Accepting the Gold Award in Electronic Payments for Datacap Systems (From Left to Right): George Hudock, VP of Business Development; Darcie McNamara, Strategic Partner Specialist; Jared Ortega, Business Development; Jannine Houston, Strategic Partner Specialist; Justin Zeigler, VP of Products

Mindful of NMI

A change at the top of NMI (Schaumburg, IL) sees the retirement of Vijay Sondhi, CEO. In his place, the payments provider has engaged fintech executive Steven Pinado. His resume includes leadership positions at Billtrust, Jonas Software, and Constellation Payments. Over the past seven years, during the tenure of Sondhi, NMI has grown from enabling 550 million transactions and $45B in annual payments volume to processing more than 5.8 billion transactions and $440B annually.

"Vijay has been an exceptional leader for NMI, guiding the company through a period of significant transformation and growth. His vision and execution helped shape NMI into the embedded payments leader it is today, and we're deeply grateful for his many contributions," testified Peter Christodoulo, Partner at Francisco Partners [Equity Investor in NMI] and Chairman of NMI's Board of Directors. "As we look to the future, we're overjoyed to welcome Steve as our new CEO. His strategic mindset and deep expertise across payments and software make him the right person to lead NMI into its next phase."

"NMI has built an impressive legacy as a leader in embedded payments infrastructure. I am honored to succeed Vijay, and excited to join this outstanding team at such a pivotal moment," relayed Pinado. "As software continues to reshape commerce, NMI is well-positioned to continue helping our partners deliver seamless, scalable payment experiences."

Steve Pinado (At Right) Succeeds Vijay Sondhi (At Left) as CEO of NMI

Copyright 2025 -- All Rights Reserved

Retail Reseller News -- Mendham, NJ USA

Michael Kachmar -- Publisher & Editor

ISSN 2769-6561