Michael Kachmar, Editor

(If not displaying properly or banners not loading, click here.)

Our Product Pick

Firich USA (Fremont, CA) has unveiled its new family of All-in-One POS: XPPC PP-9715 (15") and XPPC PP-9715W (15.6"). With Windows 10 O/S, they offer Intel Coffee Lake 8th or 9th Generation CPU, 4 GB/32 GB Memory, and PCie M.2 Solid State Drive (SSD). In slim, compact design, they feature true-flat projected-capacitive touchscreen. A dual-hinge stand allows adjustable viewing angle and height, with full suite of I/Os. An ambient light sensor adjusts the brightness of the screen according to the environment. Also, they share the same peripherals (front camera, payments, secondary display, RFID) as the Firich XPOS Series.

Firich XPPC Series POS

COMPANY BUSINESS

What's "Next" for Fiserv

A further step into the restaurant space for payments giant Fiserv (Brookfield, WI). As its latest purchase: cloud-based reservation, wait-list, and table management system provider, NexTable (Charlotte, NC). It will be integrated into BentoBox (for web design, New York, NY) and Clover (for POS, Sunnyvale, CA)--both previously purchased by Fiserv.

"Restaurant owners need centralized technology solutions that help them engage with diners directly and that are easy to use," reflected Krystle Mobayeni, BentoBox Co-Founder and Fiserv Head of Restaurants. "We're excited to join forces with NexTable to support restaurants in an innovative and meaningful way. Integration of a first-party reservation and table management system combined with point-of-sale and websites will create a powerful product offering."

"Our goal has always been to build technology that helps restaurants manage the dining experience," related TC DeSilva, Co-Founder of NexTable. "Fiserv, BentoBox, and Clover share a common goal of providing restaurants with best-in-class products and services. I'm eager to see all that we accomplish together." As some features, NexTable cites integration with Reserve with Google, direct SMS text communications, and customer relationship management (CRM).

Fiserv Adds NexTable to BentoBox and Clover

A Pile of Cash at TouchBistro

An infusion of growth financing for restaurant management platform, TouchBistro (Toronto, ON, Canada and New York, NY), extended by Francisco Partners (San Francisco, CA). The funds, $110 million (U.S.), will be used to expand product offerings, core services, and strategic acquisitions. Over the past two years, in addition to payments and POS, TouchBistro has expanded with the times into online ordering, delivery management, and customer relationship management (CRM).

"Francisco Partners shares our enthusiasm about the growth potential for TouchBistro and our customers," declared Samir Zabaneh, CEO and Chairman of TouchBistro. "In addition to providing us with access to capital, Francisco Partners also has significant domain expertise and industry connections that will enhance and accelerate our growth trajectory and acquisition plans." Started in 2010, TouchBistro has been deployed in more than 16,000 restaurants in over 100 countries.

"Our expertise in the financial technology and application software sectors makes us the perfect partner to support TouchBistro's growth and help meet its acquisition objectives," expressed Peter Christodoulo, Partner and Head of FinTech at Francisco Partners. Since its launch, Francisco Partners has invested in over 400 technology companies, making it one of the most active and longstanding investors in the technology industry. It has raised approximately $45 billion in capital.

Samir Zabaneh, CEO and Chairman, TouchBistro

Worth Your While

2023

NRF Big Show

National Retail Federation

January 15-17

New York, NY

RSPA Inspire

Retail Solutions Providers Association

January 23-26

Clearwater Beach, FL

ProMat

MHI (Materials)

March 20-23

Chicago, IL

Shoptalk

Shoptalk Commerce LLC

March 26-29

Las Vegas, NV

Transact

Electronic Transactions Association

April 24-26

Atlanta, GA

NRA Show

National Restaurant Association

May 20-23

Chicago, IL

ALL IN THE FAMILY

Bixolon: XT3-40 Marks the Spot

A new industrial label printer, Model XT3-40, has been unwrapped by Bixolon America (Torrance, CA). In form factor of 9.4"/240 mm (W) x 16.9"/430 mm (D) x 10.9"/277 mm (H), weighing 20.5 lbs./9.3 kg, the XT3-40 supports 4"/114 mm media width. In direct-thermal mode, Model XT3-40 has maximum print speed of 8"/203 mm per second at 203 dpi. In thermal-transfer mode, Model XT3-43 has maximum print speed of 6"/152 mm per second at 300 dpi.

A standard 2.4" color LCD facilitates set-up and operation, with all-metal case, side loading, double folding door, tool-less maintenance, and 450 m ribbon handling. As connectivity, there's combinations of USB, Serial, Parallel, Bluetooth, Ethernet, and WLAN. As programming languages, there's SLCS, BPL-Z, and BPL-E, with device management via XPM and XCM. As label design software, Model XT3-40 includes Bixolon's Label Artist, Bixolon's Label Artist Mobile (iOS and Android), and BarTender by Seagull Scientific.

"Bixolon is continuously extending its industrial label printer line-up," noted John Kim, Marketing Director at Bixolon Ltd. (South Korea). "Our XT3-40 is the smart choice for economic, high-volume barcode printing requirements found in logistics, manufacturing, and warehousing industries due to its compact, yet rugged, design and high-performance characteristics." It complements the Bixolon Model XT5-40 Series. Options include auto-cutter, peeler, rewinder, and rewinder+peeler.

Bixolon's XT3-40 Industrial Label Printer

Honeywell: Sweet on Payments

A mobile payment solution using enterprise hardware has been fashioned by Honeywell (Charlotte, NC). Designated as Honeywell Smart Pay, it was designed with payment software and consulting partner, Amadis (Montreal, QC, Canada). It enables mobile computers by Honeywell, including the CT30 XP and CT40 XP, to cost-effectively accept on-the-spot chip-enabled credit-card or contactless payments.

"Effortless check-out and the delivery of specialized customer service can help create loyal customers and make lasting impressions," enthused Taylor Smith, CTO of Honeywell Productivity Solutions and Services. "We designed Honeywell Smart Pay with the goal of helping merchants make consumer purchasing faster, easier, and secure--making the customer experience better." Initially, Honeywell Smart Pay supports major credit cards representing 85% of global transaction volume, with additional regional card brands to come in 2023.

"This technology emulates in software the physical secure platform and tamper detection employed on traditional payment terminals to maintain the high level of security compliance demanded by payment networks," assured Emmanuel Haydont, CEO and Co-Founder of Amadis. Since 2005, Amadis has deployed its software in more than 40 million mobile devices globally. Earlier, Haydont served as Business Architect for Desjardins Card Services, then Solutions Marketing Manager and Senior Business/Technical Consultant for Ingenico.

Introduction of Honeywell's Mobile Smart Pay Solution

Join the Party at No Charge

|

|

|

|

|

|

||

|

|

||

|

|

|

|

|

|

||

Do you need to reach the POS & Auto ID resellers who really drive business? With the most targeted editorial environment, and on the most cost-effective basis?

E-mail

Michael Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry! Use the links below to catch up:

A Message From the Editor

As we progress through another year--our 18th!--our mission remains constant: to fill the need for timely, focused, non-biased news in the channel for POS & Auto ID (and now Mobility). If anything, that need grows more pressing in the face of new technologies, go-to-market strategies, business models, and consumer expectations. We look forward to continuing our mission, and welcome your suggestions and thoughts on improvements.

Michael Kachmar, Editor

ALLIANCES

Payroc Takes the "Express"

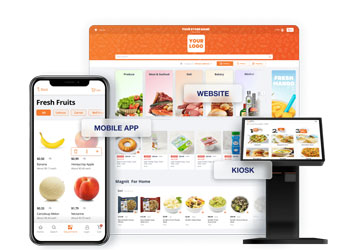

A recruitment in food and beverage, in the form of Local Express (Glendale, CA), for integrated payments player, Payroc (Tinley Park, IL). An omnichannel technology solutions provider, Local Express covers all segments of POS, including, recently, mobility, self-service kiosk, and e-commerce. As readers will recall, Payroc snapped up Worldnet in April.

"We are very proud to be working with an industry leader like Local Express. Our integration will support contactless, card-on-file billing, offering the ultimate flexibility for the consumer and easing the workload for the business owner," enthused Jared Poulson, EVP of Integrated Payments at Payroc. "Combining Local Express technology with automation of collecting payments will not only save business owners money, but more importantly, time from improved workflow improvements."

"Together, we are now able to provide food and beverage retailers in the U.S. and Canada with turn-key omnichannel technology, enabling payments directly within our platform," added Bagrat Safarian, CEO at Local Express. "With our new partnership, business owners will see tremendous savings in time and cost by streamlining the payments experience." In June, Local Express teamed for delivery with Walmart.

Payroc Recruits Local Express in Food and Beverage

EVO Mulches ISV

A partnership for non-cash payments for lawn and landscape professionals sees Lawn Buddy (Wichita, KS) with EVO Payments (Atlanta, GA). An app and web platform, Lawn Buddy has features such as automatic invoicing, digital payments, job scheduling, and crew management. It enables lawn care professionals to achieve, on average, 10x increase in business, and get paid 5x faster, according to the ISV.

"We are thrilled to partner with Lawn Buddy to enable EVO's acquiring and processing services and secure PayFabric gateway for Lawn Buddy's new and existing software customers," observed Brendan Tansill, President of the Americas at EVO. "Lawn and landscape professionals will benefit from our secure payment solutions delivered via a seamless integration to their existing Lawn Buddy software suite."

"At Lawn Buddy we are always looking for ways to improve our product and provide more value to our customers," proclaimed Steven Werner, CEO of Lawn Buddy. "This partnership with EVO does just that. With ACH and card on file, our customers will enjoy a completely integrated payments solution, are guaranteed to get paid, and will spend less on processing fees." In August, readers may recall, Global Payments (Atlanta, GA) entered definitive agreement to acquire EVO Payments.

Lawn Buddy Calls on EVO Payments for Processing

Code Corner

ID Scan net (New Orleans, LA) has added scanning/parsing support for medical marijuana cards in 19 states in the U.S. It allows the company's identity verification software, VeriScan, to support such dedicated retail/point-of-sale platforms like Dutchie, Blaze, and Cova. With it, prescription holders can enter dispensaries and purchase products using their valid medical marijuana card, without needing to provide their driver's license or passport. All of these states have legalized medical use of marijuana while recreational marijuana remains illegal. Almost five million medical cardholders live in the 19 states. Kenny Peddicord serves as Director of Cannabis Business at ID Scan net.

ID Scanning/Parsing Support for Medical Marijuana Cards

ENVIRONMENTS/PLATFORMS

A Flurry of Punchhs

A recurring revenue subscription service has been launched for loyalty software Punchh, fellow company of ParTech (New Hartford, NY). Entitled, simply, Punchh Subscriptions, it focuses, similar to Partech's POS, on restaurants and convenience stores. As readers will recall, ParTech purchased Punchh (Austin, TX) in April 2021 for $500 million.

A customizable subscription platform drives spend, increases frequency, and rewards loyalty, according to Punchh and ParTech. It has features such as subscription tracking, renewal processing, automated marketing messaging, customer targeting, and custom analytics that track impact and return-on-investment (ROI). In addition, it integrates seamlessly with mobile apps and online ordering solutions.

"We're very pleased to launch Punchh Subscriptions as we continue to revolutionize loyalty in the restaurant and convenience store sectors," indicated Savneet Singh, President and CEO of PAR, parent company of ParTech and Punchh. "Restaurant brands that integrate Punchh Subscriptions with their existing systems can now choose the right model and method to fit their specific needs. We're eager to introduce this product to the marketplace and change how restaurants and convenience stores approach the customer experience."

ParTech Launches Punchh Subscriptions

Zipping Along With BNPL

A physical card for Buy-Now/Pay-Later (BNPL) in brick-and-mortar retail has been brought to market by Zip Inc. (New York, NY). Issued by WebBank, the Zip Card extends "Pay-in-4" functionality (whereby the price of an order is split into four equal installments, due every two weeks, with the first payment due at checkout). According to Zip, it features seamless sign-up, automatic payments from linked credit or debit cards, and friendly customer reminders and notifications.

In its pilot program, an overwhelming majority--90%---of participants said Zip Card makes in-store shopping easier. With 250,000 wait-listed customers in the U.S., it supports Pay-in-4 "nearly everywhere" (in the words of the company) where Visa is accepted. An installment fee and finance charges apply. Customer service is provided 24/7 in the Zip App.

"The Zip App lets customers use the Pay-Later service pretty much everywhere--even on shopping sites where Zip is not at the check-out option," elaborated Jinal Shah, CMO for the U.S. for Zip Inc. "With the Zip Card, we are offering customers access to another fair, transparent payment method in a familiar format to use in-store, specifically at stores that do not accept contactless or mobile phone payments." Founded in Australia in 2013, Zip Inc. moved into the U.S. in 2020 with its purchase of QuadPay for $296 million.

A Physical Card for Buy-Now/Pay-Later: Zip Card

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products

and offers for resellers.

POS & Peripherals

Aldelo

Electronic Payments

Elo

Epson America

Firich USA

HP

Ingenico

National Retail Solutions

Pioneer Solution

POSBANK USA

Posiflex

Revel Systems

Sam4s/Shin Heung Precision

Shift4

Star Micronics

Sunmi

Toshiba

Tri-Tech Retail

Barcode Printers

Bixolon America

Brother Mobile

GoDEX Americas

Woosim Systems

Cash Drawers

apg/APG Cash Drawer

Star Micronics

Cash Handling Systems

apg/APG Cash Drawer

CIMA America

Data Collection

CipherLab

Code Corporation

Janam Technologies

MobileDemand

Unitech America

Integrated Payment Solutions

Datacap Systems

Electronic Payments

Ingenico

North American Bancard

Payment Logistics

Shift4

Sound Payments

Receipt Printers

Bixolon America

Brother Mobile

Epson America

Star Micronics

Woosim Systems

Stands, Mounts, Cradles

Gamber-Johnson

Touchscreens & Monitors

Elo

INSTALLATIONS

ELi Plays Tag

An innovative shelf tag system, displaying next-generation ELi QR Codes, has been embraced by grocery wholesaler United Natural Foods (Providence, RI). Developed by Cornerstone for Natural, a division of Cornerstone Consulting, Inc. (Tampa, FL), and built on SAP Business One, this "Smart Shelf Tag" provides shoppers with additional product information and digital content on their mobile phones (without requiring an app). At present, UNFI serves more than 30,000 locations throughout North America, including natural product superstores, independent retailers, conventional supermarket chains, e-commerce providers, and foodservice customers.

"Retail is changing, and we need to change with it," proposed David Williams, EVP of Business Development at Cornerstone. "Retailers and brands need to work together to engage and educate their shoppers and our Smart Shelf Tags provide this unique opportunity, helping with decision-making at a key point of purchase in the store." To date, Cornerstone has built over 120,000 ELi QR Codes for thousands of brands in consumer packaged goods (CPG). As categories, in particular, it cites vitamins and supplements, wine and spirits, natural and gourmet products, functional foods, and local items.

"UNFI is delighted to enable better transparency and communication between our suppliers, retailers, and shoppers," vouched John Raiche, EVP of Supplier Services and Merchandising at UNFI. "Consumers have shown that they care about the values and beliefs of the brands they purchase, and with Smart Shelf Tags, suppliers can communicate directly with shoppers about their products and tell the stories behind their brands." Also, UNFI has partnered in the digital coupon area with blockchain developer CoupDog (North York, ON, Canada).

United Natural Foods Bring Smart Shelf Tags, With ELi QR Codes, to Grocery

A Mile Hi ROI

An improvement in warehouse picking for Mile Hi Companies (Denver, CO) has drawn upon three major channel players: Ivanti Wavelink (Salt Lake City, UT), NCR (Atlanta, GA), and Zebra Technologies Corporation (Lincolnshire, IL). Among its customers, Mile Hi distributes food and paper-related products to 337 sites of McDonald's in the U.S. Mountain States. A new system employs Ivanti Velocity (for network device management and browser console) and Ivanti Speakeasy (for voice enablement), NCR's Power Warehouse Management System (WMS), and Zebra's WT 6300 wearable mobile computer (running Android).

To modernize the picking process, Mile Hi moved away from check-digit pick confirmation and toward scan confirmation. A low SKU count within distribution centers (for example, the cooler at sub-company Mile Hi Foods has roughly 40 unique SKUs) often created opportunities for check-digit memorization. This, in turn, led to mis-picks. As benefits of the scan-based system, Mile Hi Companies cites: overall credit reduction of 48%, 43% cost savings of $4,960 per selector, and 66% reduction in training time from three days to one day.

According to Brian Evans, Manager of Continuous Improvement at Mile Hi Companies: "With Ivanti Velocity we can have the screen look exactly how we want--no scrolling necessary. We were able to fit everything on the screen plus strip out a lot of ancillary data with no value-add. So, selectors get their location, their item number, a brief description, and a field to scan the barcode. That's all we needed."

A New Scan-Based Picking System for Mile Hi Employs Ivanti, NCR, and Zebra

Channel Factoid

What's Cooking In Restaurant Tech

(2017 - 2022)

-About 30% of restaurant owners are thinking of changing their provider of POS in the next twelve months.

-Upfront costs of POS have fallen more than 30% since 2017, to an average spend of $9,289.

-On the other hand, monthly fees have increased by 274% since 2017, to an average spend of $379.

-In 2017, 84% of respondents were satisfied with vendor support, but in the most recent survey, that proportion dropped to 69%.

-Almost half of those surveyed in 2022 said they are locked into using their system's credit-card processor.

-60% of respondents report they use one or more handheld devices in their operations in 2022, compared with only 27% in 2017.

-Many respondents admit they do not use many of their POS's features because they are hard to implement or operators lack the time and support to get the necessary training.

Source: "2022 POS Survey Report" by Restaurant Owner com (Phoenix, AZ).

30% of Restaurant Owners May Switch Their POS

In Memoriam

A note of thanks to M.H. "Lefty" Monson, who passed away on Sunday, November 6. A true legend in our industry, Lefty founded two nationally recognized, award-winning firms, ECR Sales Management and POS Sales Management. With his trademark hat, casual clothes, and smile, he was ever generous with his advice, encouragement, and knowledge. As sales trainer, mentor, and industry advocate, he shined. An unforgettable friend.

Lefty Monson Passes Away

HELLO GOODBYE

Sketching New Business With Eazell

An industry veteran, Steve Eazell, has joined Beyond Bancard (Orange, CA) as VP of Business Development. Previously, Eazell was VP of Strategic Partnerships at First American Payment Systems, SVP of Strategic Partnerships at PayVida Solutions, VP of Sales and Business Development at Eagle Processing, and VP of Strategic Partnerships and Business Development at Secure Payment Systems. As partners, Beyond Bancard welcomes VARs, ISVs, and Merchant Sales Agents.

"We are extremely excited to add Steve to our team," commented Jasmit 'Jimmy' Virk, CEO and Founder of Beyond Bancard. "He brings decades of industry experience along with the same core values that we believe in here at Beyond Bancard. He will be a perfect fit to lead our Business Development efforts as we continue our growth."

"I am thrilled to bring my extensive experience and background to such a tremendous and burgeoning organization as Beyond Bancard," shared Eazell. "They have made great strides in becoming one of the true leaders in the industry." Established in 2016, Beyond Bancard shouldn't be confused with Beyond, started by Robert Carr, founder of payment processor Heartland Payment Systems, which launched in 2017.

Steve Eazell, VP of Business Development, Beyond Bancard

Our Man in Asia-Pacific

A new representative for the Payment Card Industry Security Standards Council (PCI SSC) in the critical region of Asia-Pacific: Yew Kuann Cheng. He joins the standards organization from Visa, where he served for 15 years as Senior Director, Risk Strategy, and Operations for Asia-Pacific. Additional roles have included Head of Security, Technology, and Risk with payments provider QB Pte Ltd., Senior Consultant with Ernst & Young, and IT Analyst with Infocomm Media Development Authority (previously the National Computer Board).

"Yew Kuann brings a unique set of skills and knowledge to the PCI SSC," remarked Lance Johnson, Executive Director of the PCI Security Standards Council, (Wakefield, MA). "Yew Kuann will play a key role in our continued focus on Asia-Pacific as a priority region for payment security." He will stay based in Singapore.

"I'm elated to tackle this new challenge and look forward to working with payment industry stakeholders throughout the region," contributed Cheng. "My background in payments, fraud risk management, and compliance, and my passion for security can help organizations understand the importance of what the PCI SSC does and why it matters. We all need to be working to combat the threats that are out there today."

Yew Kuann Cheng, Regional VP for Asia-Pacific, the PCI Security Standards Council

Copyright 2022 -- All Rights Reserved

Retail Reseller News -- Mendham, NJ USA

Michael Kachmar -- Publisher & Editor

ISSN 2769-6561