Michael Kachmar, Editor

(If not displaying properly or banners not loading, click here.)

Our Product Pick

Touch Dynamic (South Plainfield, NJ) has showcased its new Fusion Hybrid Tablet. As display, it features true-flat 11.6" projected-capacitive touchscreen (resolution, 1920x1080; brightness, 300 nits; aspect ratio, 16:9; LCD/LED). A button releases the tablet from the base for portability; in countertop configuration, an electronic lock holds the tablet in place. As computing, it furnishes Intel Elkhart Lake Celeron J6412 at 2.6 GHz, 8 GB RAM, 128 GB eMMC, and Intel HD Graphics. A full suite of ports is offered, including Powered USB, with options for MSR, 2D Scanner, Fingerprint Reader, RFID and Rear Camera. Available for evaluation in mid-October, it supports Windows 10 IoT, Windows 11, and Linux.

Fusion Hybrid Tablet by Touch Dynamic

COMPANY BUSINESS

Across the Universe (with UDC 8112)

A group of seven stakeholders in consumer packaged goods (CPG) has started the first end-to-end pilot test--including digital clearance and real-time reconciliation--of the 8112 Universal Digital Coupon. As members, this group includes Fobi AI, IT Retail, LaGree's Food Stores, nData Services, SMS Promotions, The Coupon Bureau, and Wells Enterprises (makers of Blue Bunny Ice Cream). In 2016, readers may recall, the Joint Industry Coupon Council and the Association of Coupon Professionals drove development of the new GS1 Standard, Application Identifier (AI) 8112.

A pilot is taking place at three LaGree's Food Stores in Colorado. Customers are sent coupons, created in the Qples Platform by Fobi AI, and delivered to their mobile phones, for ice cream by Blue Bunny. Alternatively, customers may use the Qples QR Code from in-store signage provided by SMS Promotions. Upon purchase, The Coupon Bureau validates in real-time, with integration provided by POS VAR, IT Retail. Next, the coupon is reconciled by nData Services. Finally, attribution data is provided in an online portal by Qples by Fobi AI.

"It has been incredible to see these seven different companies come together to successfully launch this pilot of the 8112 Universal Digital Coupon," reflected Jeff Hudson, Chief Integrations Officer at the non-profit The Coupon Bureau (Fort Worth, TX). "This pilot shows that the new 8112 industry standard works flawlessly, and that there are significant benefits for all the players involved. We look forward to seeing widespread implementation of the 8112 Universal Digital Coupon in the marketplace shortly."

Universal Digital Coupon on Qples Platform by Fobi AI (Vancouver, BC, Canada)

Dear NCR Customers and Partners

On the website of NCR: "Earlier this year, the NCR Board of Directors launched a comprehensive strategic review process to unlock the value of our business. Yesterday we announced that our Board approved a plan to separate NCR into two independent, separately traded companies--one focused on digital commerce, the other on ATMs."

"The digital commerce company will leverage NCR's software-led model to continue transforming, connecting, and running global retail, hospitality, and digital banking customers' technology platforms. The ATM company will focus on delivering ATM-as-a-Service to a large, installed customer base across banks and retailers."

"Throughout the strategic review process, we received material interest in a whole company sale of NCR, as well as interest in various individual segments of our business. In recent days, it has become increasingly clear to the Board that given the state of current financing markets, we cannot deliver a whole company transaction that reflects an appropriate and acceptable value for NCR to our shareholders"

NCR to Split Into CommerceCo and ATMCo

Worth Your While

NACS

Association for Convenience and Fuel Retailing

October 1-4

Las Vegas

Channel Connect

ScanSource

October 2-5

Nashville, TN

MJBizCon

MJBizDaily

November 15-18

Las Vegas, NV

2023

NRF Big Show

National Retail Federation

January 15-17

New York, NY

RSPA Inspire

Retail Solutions Providers Association

January 23-26

Clearwater Beach, FL

ProMat

March 20-23

Chicago, IL

ALL IN THE FAMILY

Sound Hears Need for POS

An in-store POS for the convenience/gas segment has been unwrapped by Sound Payments (Jacksonville, FL). Its software runs on multiple device configurations--countertop and/or mobile--in formats either independently or semi-integrated with the customer's existing POS. Addressing retail and deli, it supports all major credit cards, gift cards, loyalty cards, and cash discounting, according to Sound Payments.

"With our Sound Easy Pump proven and installed at stations, Sound POS is a natural next addition to our petro product line," suggested Andrew Russell, President of Sound Payments. "Stores can operate their business more efficiently by managing inventory, pricing, payroll, sales by device, and consumer shopping trends from PC, tablet, or mobile device via the cloud portal." Upgrades in features and compliance requirements will be provided by Sound Payments.

As its name denotes, Sound Easy Pump enables EMV-at-the-Pump. A semi-integrated solution with security measures for customer data, it supports contactless payments via card tap or NFC, MSR, and Chip & PIN, and features scanning of QR Codes, PIN-on-Glass, and Remote Key Injection (RKI). Sound Payments works with resellers, referral partners, and installers to market Sound Easy Pump and Sound POS.

Sound Payments Debuts Sound POS

No Double Dipping (for U.S. Patent #16,409,359)

A patent for the subject of Single DIP EMV--assigned as U.S. #16,409,359--has been awarded to IntelliPay (Draper, UT). Entitled "System and Method for Processing Chip-Card Transactions from a Host Computer," it facilitates payment of taxes and fees. With this, one payment is split into two: one for the government invoice amount, and as the second, one for the service fee that covers such processing costs. So, it eliminates the need for two insertions, streamlining operations.

Available to local and state governments, it's delivered as a stand-alone or integrated solution (in the later, via Application Programming Interfaces, APIs). A stand-alone version requires web access to IntelliPay's virtual OneTerminal or Lightbox EMV solution and an integrated Augusta Reader from ID Tech (Cypress, CA). "We have been able to streamline our tax collection process, and our citizens love the convenience and ease of use," reported one early user, the Tax Collection Officer in Roberts County, South Dakota.

"IntelliPay has always been hyper-focused on the customer experience (or CX), as we develop, deploy, and support new solutions. Like all our products, we developed our new chip-card solution with a frictionless customer payment experience in mind for both staff and customers," indicated Casey J. Leloux, CEO of IntelliPay. "We set ourselves apart by customizing our payment products, services, and solutions to how the agency does business, not bending the agency to how we think your operations should work."

Single DIP EMV Payment Processing by IntelliPay

Join the Party at No Charge

|

|

|

|

|

|

||

|

|

||

|

|

|

|

|

|

||

Do you need to reach the POS & Auto ID resellers who really drive business? With the most targeted editorial environment, and on the most cost-effective basis?

E-mail

Michael Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry! Use the links below to catch up:

A Message From the Editor

As we progress through another year--our 18th!--our mission remains constant: to fill the need for timely, focused, non-biased news in the channel for POS & Auto ID (and now Mobility). If anything, that need grows more pressing in the face of new technologies, go-to-market strategies, business models, and consumer expectations. We look forward to continuing our mission, and welcome your suggestions and thoughts on improvements.

Michael Kachmar, Editor

ALLIANCES

A Serving of Bluefin and Sunmi

A marriage of software and hardware for integrated payments has been celebrated by two players in our channel: Bluefin and Sunmi. Under this new partnership, Bluefin will work to certify the payments terminal line of Sunmi, including the P2, P2 PRO, P2 Mini, and P2 SMARTPAD. (In the U.S., both firms are sited in Greater Atlanta, GA.)

A pioneer in point-to-point encryption (P2PE), Bluefin features certification with over 100 payment devices from leading manufacturers, 16 partner Key Injection Facilities (KIFs), an online device management and tracking system, entitled P2PE Manager, and tokenization via its platform component, called ShieldConex. In turn, Sunmi's P2 Series, for countertop and handheld environments, supports omnichannel capabilities for Chip & PIN, NFC, and QR Codes. An increased interest in VARs, ISVs, and ISOs on the part of Sunmi.

"We are excited to partner with Bluefin to be able to deliver highly functional payments solutions that are both affordable and secure. Solutions that were previously only accessible to Tier 1 and 2 retailers--such as loyalty, digital marketing, buy now/pay later (BNPL), and QR Codes, as well as niche applications--are now within reach of small to medium-sized businesses (SMB)," enthused Mike Morris, VP of Payment Solutions at Sunmi. "We look forward to partnering with Bluefin, the leader in PCI-validated encrypted payments, to bring our payment terminals to their large base of healthcare, higher education, government, and retail clients."

Bluefin Certifies P2 Series of Payment Terminals by Sunmi

Lavu Flows With QR

A pay-at-the-table solution by Up 'n go (San Diego, CA) has been embraced by supplier of iPad POS, Lavu (Albuquerque, NM). A custom-branded digital check, bearing the QR Code, appears on the customer's smartphone. In addition to seamless, contactless payments, cited benefits include dashboard and split checks. Established in 2016, Up 'n go powers approximately 700 restaurants in the U.S., including sites of brands such as P.F. Chang's, Old Spaghetti Factory, and Tupelo Honey.

"By integrating Up 'n go's pay-at-the-table solutions into our software, we are advancing our mission of helping restaurants simplify operations, empower their staff, and provide the best customer experiences," expressed Saleem S. Khatri, CEO of Lavu. "The demand is clear, as is the superiority of Up 'n go's solutions in the market, making this a logical and natural partnership." As it promotes, Lavu was the first iPad-based POS in the Apple App Store.

"At Up 'n go, we are passionate about using technology to simplify the lives of restaurant owners and to offer the best user experience for diners," expounded Touradj Barman, CEO of Up 'n go. "So there is a natural synergy with Lavu, a mission-driven company and leader in the restaurant tech space. We are delighted to partner with them to equip restaurants with the best tools to save time and increase revenues." (FYI: Also integrations for Up 'n go: NCR Aloha and Oracle/Micros.)

Lavu Adds Pay-at-the-Table From Up 'n go

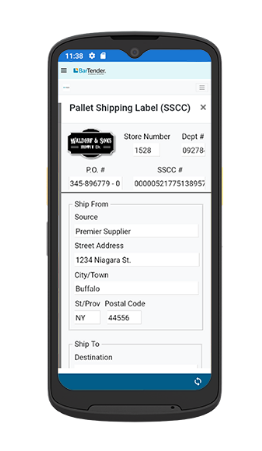

Code Corner

Seagull Scientific (Bellevue, WA) has released its BarTender Mobile App for Android. With its capacity for printing labels, barcodes, documents, and tags (with RFID), as an extension to BarTender, it helps to drive efficiency, improve productivity, and reduce costs, notes Seagull Scientific. Available for free download on the Google Play Store, it works in conjunction with the BarTender 2022 Enterprise, Automation, and Professional Editions. "A significant evolution of our platform means more organizations can now enjoy seamless, consistent printing across the enterprise," projected Harold Boe, President and CEO of Seagull Scientific. "By putting the right tools directly into the hands of the people who need them, we're enabling responsive action on the logistical front lines--whether it's in production, in the warehouse, at the retail store, or in the field. And our centralized template management system ensures label consistency and compliance."

Seagull Releases BarTender Mobile App

ENVIRONMENTS/PLATFORMS

PNC "Banks" on Linga POS

A move by banking into POS, with the purchase of Linga POS (Naples, FL) by the PNC Financial Services Group (Pittsburgh, PA). Founded in 2004, focused on hospitality, Linga developed one of the first all-in-one cloud-based platforms, Linga rOS. Now in 48 countries, it has added payments, online ordering, QR Code-based menus, and virtual kiosks.

"This acquisition reflects our continued commitment to expanding our corporate payments capabilities, as well as investing in the solutions and tools our clients need to run their businesses more effectively," postulated Emma Loftus, EVP and Head of PNC Treasury Management. "By leveraging Linga's proprietary solutions and PNC's competitive treasury management platform, we will be able to provide our restaurant and retail clients with the tools they need to keep up with ever-changing consumer expectations." (In announcing the deal, terms were not disclosed.)

"We believe this is an exciting opportunity to continue to grow our business and support our existing channel partners and clients, and to do so with a company that shares our vision of delivering innovative and high-quality solutions," shared Onur Haytac, Founder and CEO of Linga. "As we've worked with PNC over the last several years, we've had incredible success with our combined payments capabilities and we look forward to continuing this strategic collaboration." According to PNC, Haytac will continue to lead Linga's existing management team, employees in the U.S. and Canada, and channel partners and clients.

Onur Haytac, Co-Founder and CEO of Linga POS, Now Part of the PNC Financial Services Group

Maui Wowie POS

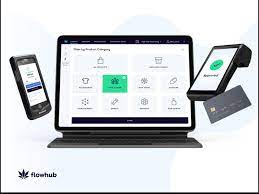

A firing up of its new retail platform for cannabis sales by Flowhub (Denver, CO), aptly designated "Maui." Supporting iPads, Macs, or PCs, it furnishes extended, dedicated functionality, such as easy, flexible regulatory compliance, multi-state universal log-in, improved inventory management, extensible product catalog, integrated payment processing, automated marketing and promotions, and mobility (via apps of "Greet" and "Stash," in concert with its scanner combination of iPhone and Honeywell Sled, called "Nug Pro"). Its new back-end architecture is 20x faster than the company's legacy platform, according to Flowhub.

"So far technology providers have struggled to keep up with today's dispensary needs and consumer expectations," asserted Kyle Sherman, Founder and CEO of Flowhub. "With Maui, Flowhub gives full control back to dispensaries. We've taken diligent customer feedback to deliver a cutting-edge, mobile-first operating system primed for this multi-billion-dollar industry. We're here to power the upcoming explosion of innovative retail experiences that will sustain healthy cannabis sales."

Maui will be available in all markets for Flowhub, including the recently entered New Jersey, West Virginia, and South Dakota. It arrives on the heels of Flowhub's $19 million strategic fund-raising in 2021, led by venture firms Headline and Poseidon (both sited in San Francisco, CA), as well as personal investment from Shawn Carter, better known as Jay-Z. To date, the company has raised nearly $50 million in capital, bringing its current valuation to over $200 million. It processes over $3 billion in cannabis sales annually, with than 1,000 retailers.

Flowhub's New Platform for Cannabis Sales: Maui

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products

and offers for resellers.

POS & Peripherals

Aldelo

Electronic Payments

Elo

Epson America

FEC USA

HP

Ingenico

National Retail Solutions

Pioneer Solution

POSBANK USA

Posiflex

Revel Systems

Sam4s

Shift4

Star Micronics

Sunmi

Toshiba

Tri-Tech Retail

Barcode Printers

Bixolon America

Brother Mobile

GoDEX Americas

Woosim Systems

Cash Drawers

apg/APG Cash Drawer

Star Micronics

Cash Handling Systems

apg/APG Cash Drawer

CIMA America

Data Collection

CipherLab

Code Corporation

Janam Technologies

MobileDemand

Unitech America

Integrated Payment Solutions

Datacap Systems

Electronic Payments

Ingenico

North American Bancard

Payment Logistics

Shift4

Sound Payments

Receipt Printers

Bixolon America

Brother Mobile

Epson America

Star Micronics

Woosim Systems

Stands, Mounts, Cradles

Gamber-Johnson

Touchscreens & Monitors

Elo

INSTALLATIONS

Wendy's Gambit: ItsaCheckmate

A major contract win for ItsaCheckmate (New York, NY), with deployment of its solution for integration of third-party delivery channels by burger chain Wendy's. All 6,000 sites of Wendy's in the U.S. and Canada will employ the technology. In addition to such third-party delivery integration optimization, expected benefits will include easier restaurant rollout, improved menu management, and deeper data/metrics.

"We selected ItsaCheckmate because of their ability to integrate with the Wendy's digital platform and quickly bring on new delivery providers," commented Matt Spessard, CTO at Wendy's. "Their excellent service and support, backed by a robust technology, helps alleviate pressure from our team and allows us to scale rapidly." As its platform of POS, Wendy's has chosen Panasonic Connect (Newark, NJ).

"Our teams and technology have been proven at all levels of the restaurant industry," proclaimed Vishal Agarwal, Founder and CEO of ItsaCheckmate. "Wendy's adoption of our solution further validates our strategy of first listening to our customers to understand how we can bring value and then delivering during deployment to help them achieve their goals quickly." As partners, ItsaCheckmate has more than 50 POS systems and more than 75 ordering platforms, including UberEats, DoorDash, Grubhub, and--most recently--Google.

Enhanced Third-Party Delivery Integration for Wendy's

Saving Face at POS

A step into retail for facial recognition, with CyberLink's FaceMe Software Development Kit (SDK) powering POS. It has been fielded at the Ministop Pocket--an unmanned, "micromarket," convenience store, which also serves as technology demonstration center--in the headquarters of business software conglomerate CAC Corporation (Tokyo, Japan). Opened in February, it serves 1,100 employees, who no longer pay for items via cash, card, or mobile wallet.

Upon enrollment, an encrypted template of the employee's face gets stored in the database for identity verification. After facial scanning, the purchase price of items gets deducted from their next paycheck. An accuracy of 99.73%, error rate (false match rate) as low as 1 in 1 million, and secure built-in "liveness and anti-spoofing capabilities" are quoted as system performance.

"By incorporating facial recognition into CAC's POS terminals, their employees can now effortlessly pay for items within the Ministop Pocket, even if they forget their wallet at their desk," related Dr. Jau Huang, Chairman and CEO of CyberLink (Taipei City, Taiwan and San Jose, CA in the U.S.). "The scalability and flexibility of CyberLink's FaceMe also allows for future incorporation of additional analytical functionality, such as emotion analysis, to enhance employee wellness programs." Established in 1996, CyberLink focuses on multimedia software, facial recognition, and Artificial Intelligence (AI).

CyberLink's FaceMe Facial Recognition in the POS

Channel Factoid

Loss Prevention Horizons

% of Retailers Implementing

or Planning to Implement:

38.6% - RFID Systems

29.8% - Video Analytics

for POS/Supply Chain

17.5% - Locking Product Cases

14.0% - Perimeter Surveillance

12.3% - Facial Recognition

12.3% - Surveillance Towers

10.5% - AI-Based Access Control

5.3% - Security Robots

3.5% - AI-Based Behavior Detection

1.8% - Fingerprint Biometrics

for POS/Supply Chain

0.0% - Drones

Source: "2022 Retail Security Survey," Conducted by the National Retail Federation (Washington, DC)

A Range of Technologies, Including Video Surveillance, Fights Shrink and Theft

HELLO GOODBYE

New Prez for PayTrace

A new President for PayTrace (Spokane, WA): Greg Castro. He replaces Founder and Former CEO, Scott Judkins. A extensive resume for Castro includes GM and SVP for business-to-business (B2B) at Evo Payments, VP of Sales at Monetary, VP of Business Development at iPayment, SVP of Sales and Marketing at SilverEdge, and Director of Channel Development at Mercury Payment Systems.

"PayTrace is successful because of its strong foundation of people, technology, and processes," declared Castro. "You can't build a great house without a strong foundation. Our team is constantly seeking ways to improve on our current success. We want to be a leader in the B2B customer ecosystem--not only on the technology and processing side, but on the customer experience side as well."

"Greg brings a wealth of experience and knowledge in the B2B landscape," relayed Justin Goes, PayTrace's COO. "PayTrace has traditionally been focused on B2B verticals, so we are well positioned to further penetrate this space under Greg's leadership." (FYI: North American Bancard acquired PayTrace at the end of 2021.)

Greg Castro, President, PayTrace

Ambition at FAPS

A new Strategic Partnership Manager at First American Payment Systems (Fort Worth, TX): Nathan Cedor. His two decades of experience includes roles as SVP of Partner Solutions with Atlantic-Pacific Processing Systems, VP of Account Management with TSYS, and VP of Account Management with Bank of America. He will report to John Newton, VP of Strategic Partnerships.

"Nathan's experience, charisma, and ambitiousness will complement our sales team and help us both discover new leads and close contracts," stated Newton. "We're thrilled to have him on the team as we enhance our product solutions to support both partners and merchants in the digital marketplace." (FYI: In 2021, First American Payment Systems was purchased by financial services firm, Deluxe.)

Nathan Cedor, Strategic Partnership Manager, First American Payment Systems

Copyright 2022 -- All Rights Reserved

Retail Reseller News -- Mendham, NJ USA

Michael Kachmar -- Publisher & Editor

ISSN 2769-6561